Co-borrower Experience in the Loan Application

We upgraded the co-borrower experience in order to:

- Enable co-borrowers to complete their own sections of the loan application and to complete any follow-up tasks.

- Allow borrowers to decide if they would like to share financial and personal information with their co-borrowers or if they would like to partition that data and keep it private.

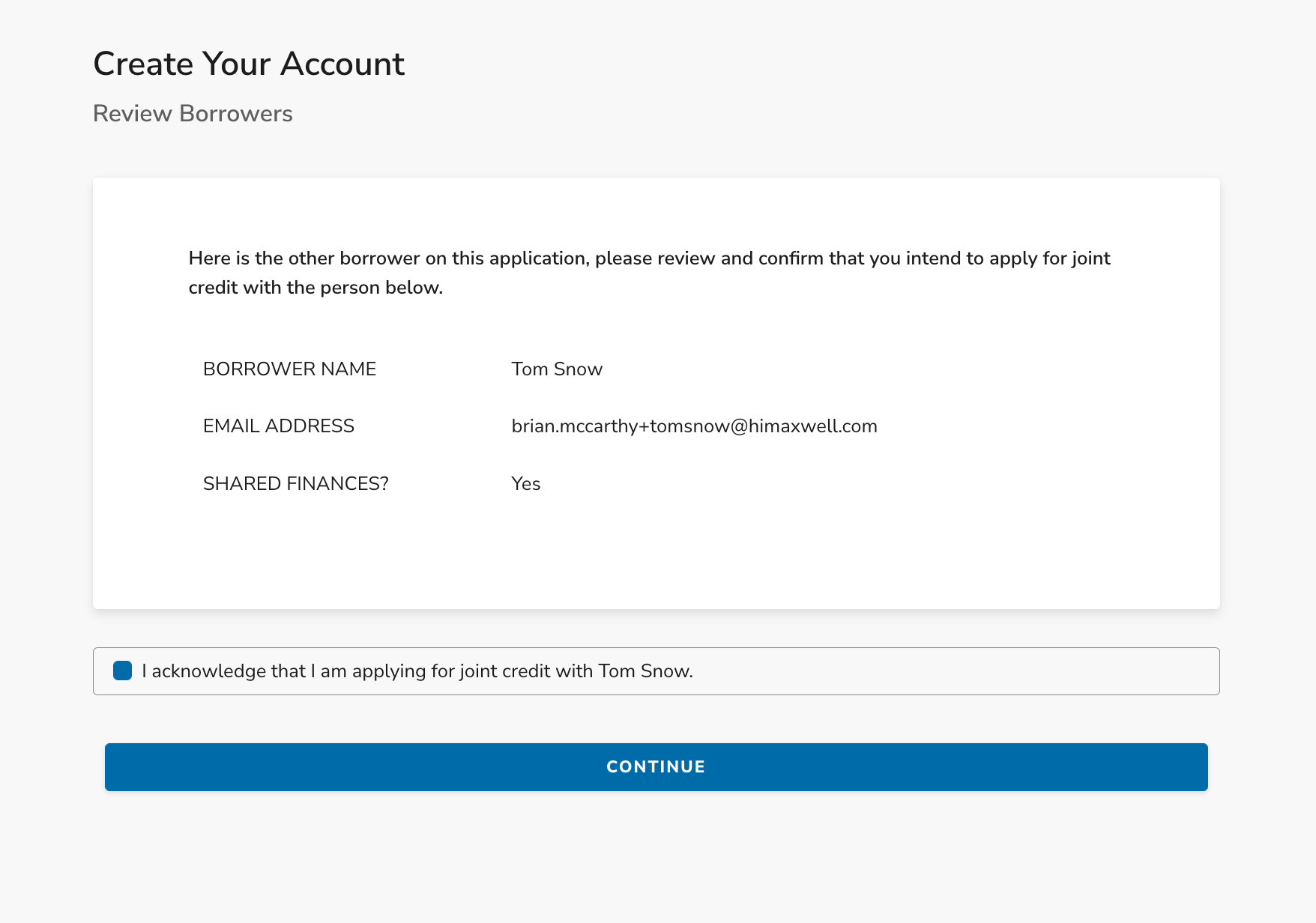

- Ensure that each borrower provides their own explicit authorizations for intent to apply for joint credit and use of electronic documents and signatures to comply with ECOA, the E-Sign Act and CFPB standards.

- Lay the foundation for Maxwell to add multiple co-borrowers

How the Co-borrower Experience Works

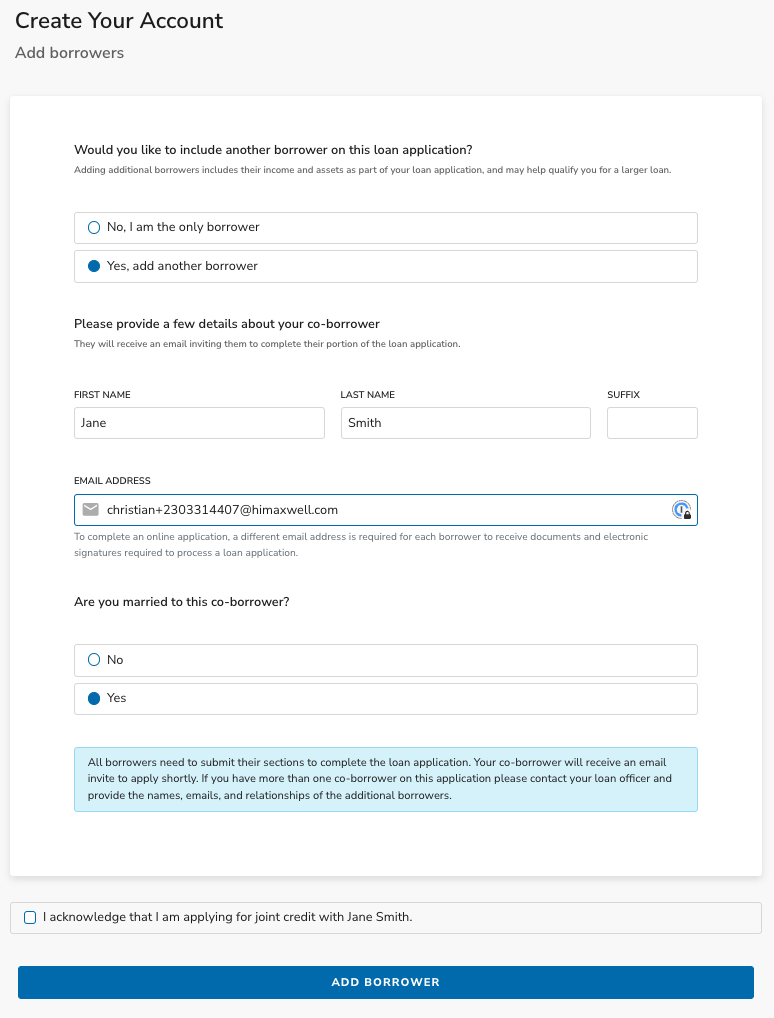

After the borrower creates their account and begins their application they are immediately prompted with the question if they would like to add a co-borrower. If they say yes, they will be asked a few questions about their co-borrower to create their account.

Similarly, if you start the loan application from your dashboard, there will be a place to enter in co-borrower information when filling in information for the borrower.

Married Borrowers & Shared/Split Finances

During this experience, the borrower is asked if they are married to their co-borrower. If they say Yes:

- Assets & Liabilities and Loan information will be shared between borrowers

- After completing the application the borrower will receive a prompt to begin the co-borrower application

- Documents and Tasks will be shared between borrowers

- The borrowers will be positioned as borrowers 1 & 2 in the LOS

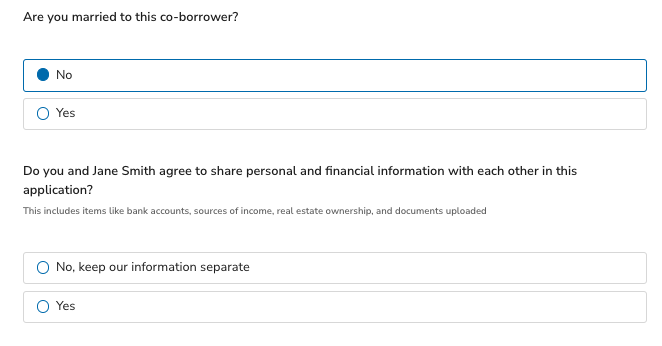

If the borrower indicates they are not married to the co-borrower:

- The borrowers will be positioned as borrowers 1 & 3 in the LOS

- The co-borrower will receive an email to begin their application once added to the loan file

- The borrower will be asked if they share finances with this co-borrower

If they share finances:

- Assets & Liabilities and Loan information will be shared between borrowers

- After completing the application the borrower will receive a prompt to begin the co-borrower application

- Documents and Tasks will be shared between borrowers

If they say No, Keep our Information private:

- Assets & Liabilities will not be shared between borrowers on the application

- Documents & tasks will not be shared between borrowers

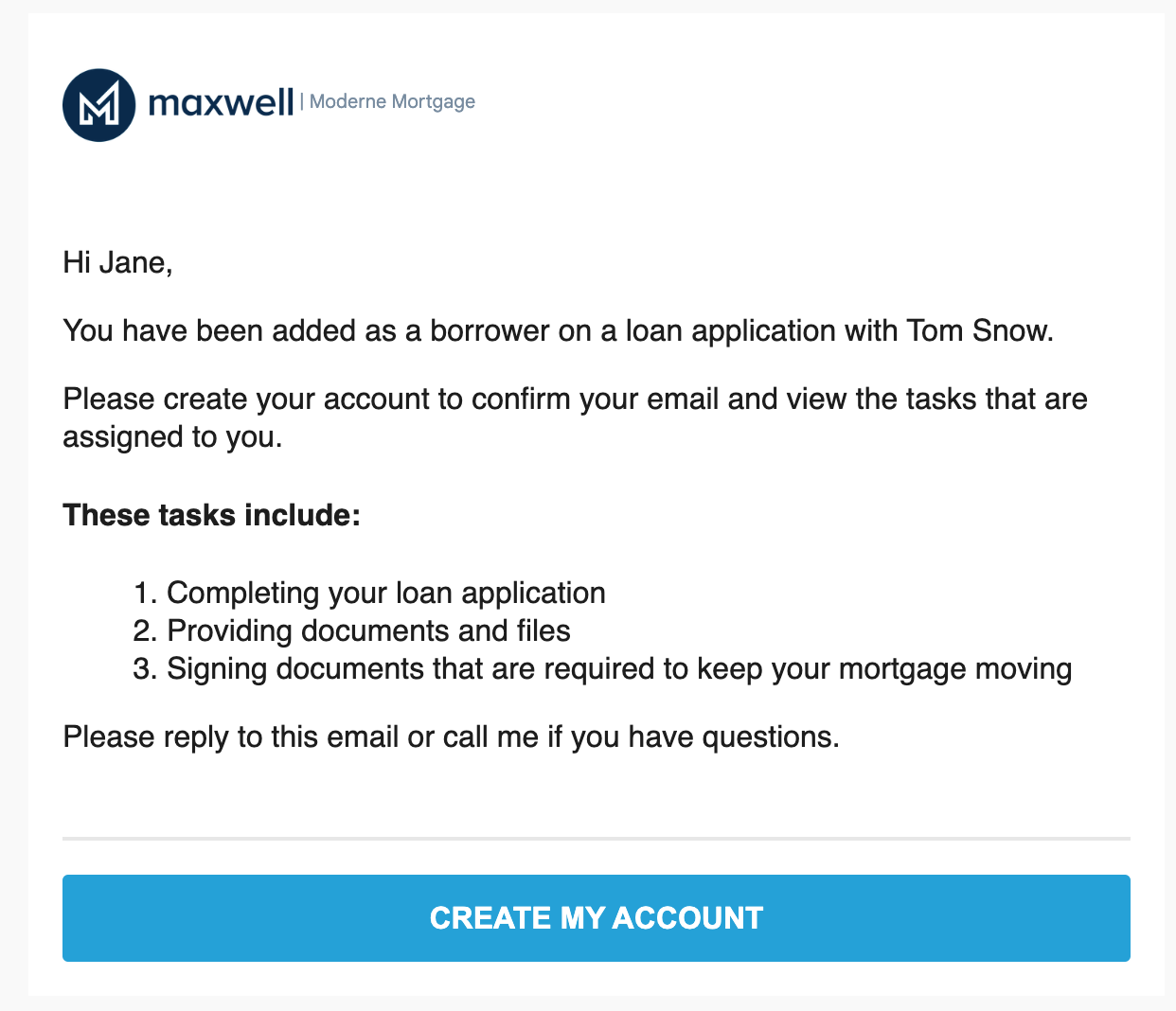

Co-borrower Welcome Email

After the borrower adds a co-borrower, the co-borrower will receive an email to login to Maxwell to complete the loan application and other tasks assigned to them.

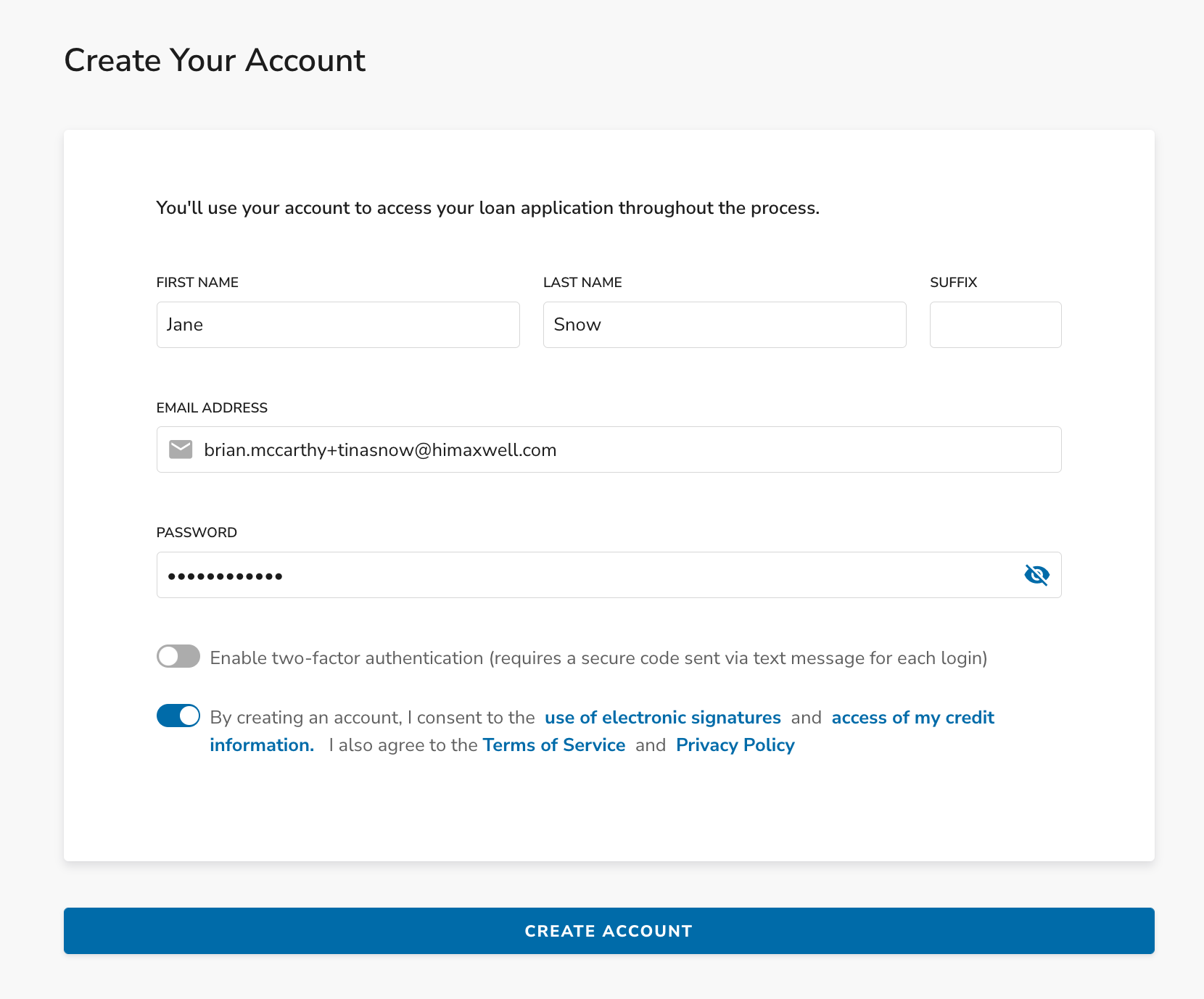

Co-borrower Consents

The co-borrower needs to login to provide their consent for credit authorization and e-signatures and then they can begin and complete their application.

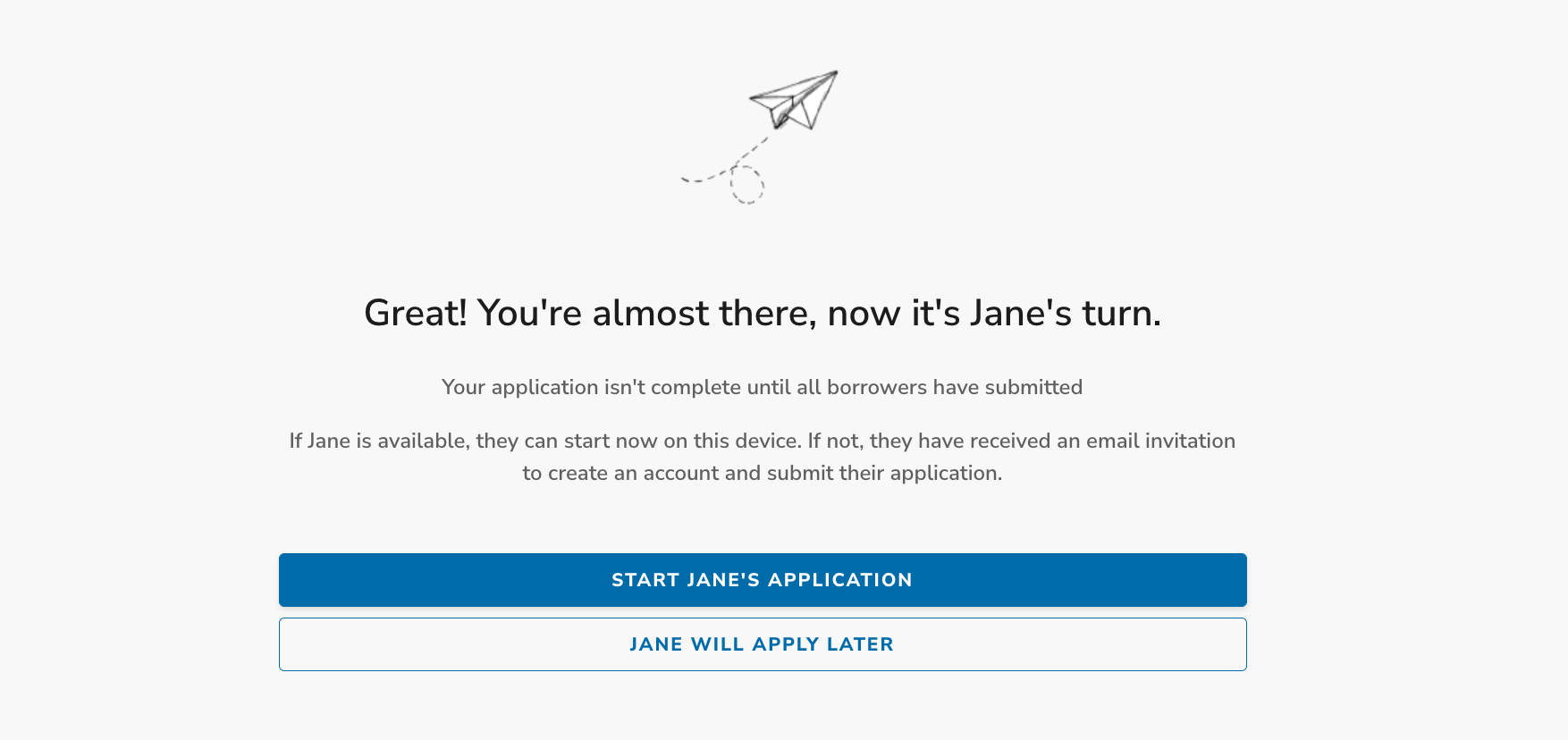

Completing a Co-borrower App on the Same Device

If the two borrowers are on the same device and indicate they are married or sharing finances, once the first borrower submits their application they will see a screen asking if the co-borrower would like to complete their application at this time or if they will complete the application later. If they would like to start on that device, it will prompt the co-borrower to login, provide their consent and begin the application.

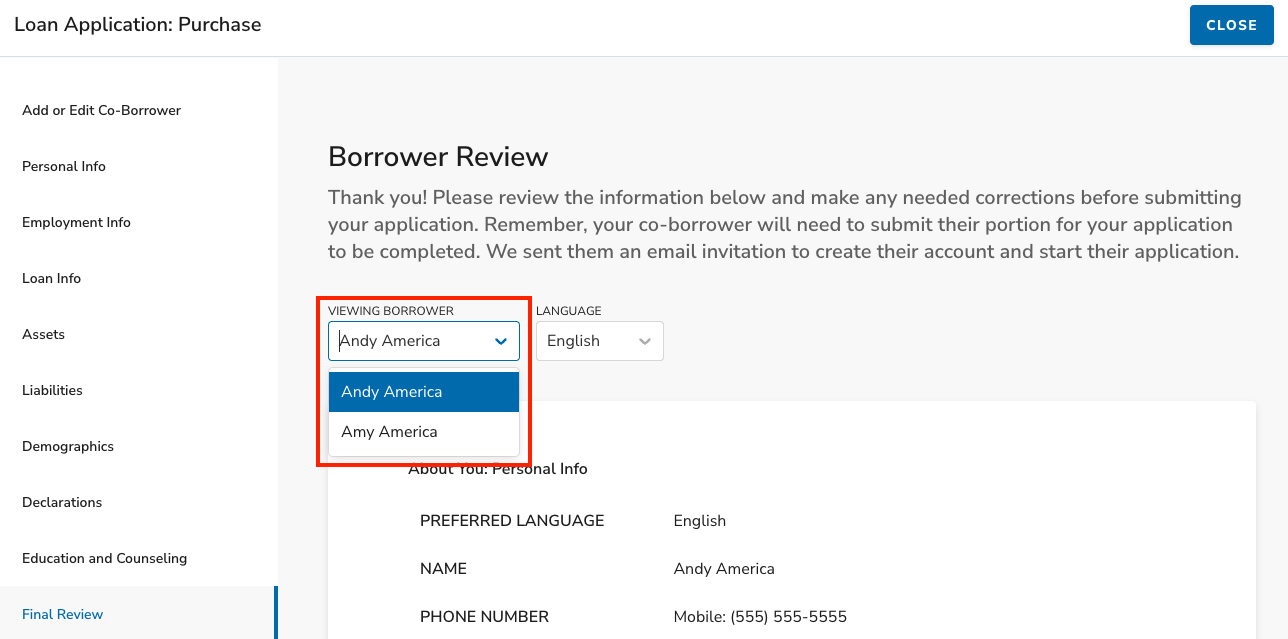

Lender Review of Co-borrower Applications

Any member of the Lending team can view either borrower's loan application by clicking on the loan application task and then using the Borrower selection dropdown above the loan application.

FAQs

Do you allow two co-borrowers to use the same email?

We strongly recommend that borrowers use their own emails so they can receive their own notifications on the loan file and ensure information security between borrowers. It is also a requirement to have individual emails for some of our electronic document signature integrations. That being said we do realize there are some borrowers who do not have multiple emails, so if you

Can one borrower complete the application for themself and the co-borrower and provide all the authorizations?

In order to protect all borrowers from identity theft and fraud and ensure compliance with the Equal Credit Opportunity Act and E-Sign Act each borrower is required to login and provide their explicit consent to credit authorization, e-signatures, and verification of all information being submitted on the application in order for an application to be considered complete.

Do you support multiple co-borrowers on an application?

We are working towards multiple borrower support in both the Maxwell application and with our LOS integration partners. This is on our roadmap but not yet available in Maxwell.

Can I add a co-borrower after the application is submitted?

If you are connected to a LOS we recommend that if you need to add a co-borrower after the loan application is submitted to do so in the LOS. We only sync data to the loan application one time, so even if you collect data via Maxwell that data will not automatically update to the LOS.

In the event you need to add another borrower to collect data in Maxwell you can do so by opening the loan application, going to the additional borrower question and changing the response from no to "yes" and adding the co-borrower contact info. Please note you will either need to upload that data to your loan file via the 3.4 or you will need to enter it into the LOS manually.