Product Overview

We upgraded our loan application to make it easier and faster for borrowers to complete while delivering the crucial data your lending teams need to qualify applications and begin processing. Our loan application features:

- Mobile-friendly page design – The application is easy to navigate across any device; smartphone, desktop, or tablet.

- Fast completion time – We use smart display logic based on the borrower's responses--they only see the questions they need to answer and skip questions that do not apply.

- Complete URLA Application – All questions mapped to the latest URLA and 3.4 Mismo data specs for effortless LOS integrations

- Spanish Application – An end-to-end translated application experience for Spanish borrowers for organizations who plan to use this feature.

Starting Loan Applications

There are three ways for to begin a Loan Application.

- From your Landing Page

- Inviting a borrower & assigning them a loan application task

- Interview-style

Landing Page Link

For many, the most common way that borrowers get to your application is via your landing page. Many of our clients place this link in their marketing materials as a call to action. Click here to learn more about Maxwell Landing Pages

When the borrower reaches your landing page, they will click the “Apply Now” button to be brought to the Loan Purpose page. The borrower can select which type of application they would like to fill out. Based on your organization template settings, the borrower may see Purchase, Refinance, or Home Equity. Your organization may also have other, custom loan applications.

Inviting a borrower and assigning a loan application task

This article covers how to create a loan file for a borrower and assign them a loan application task.

Interview Style Loan Application

If you have the borrower in person or on the phone and wish to fill out the application on their behalf, you can do so after you've created the loan application task in the borrower's loan file.

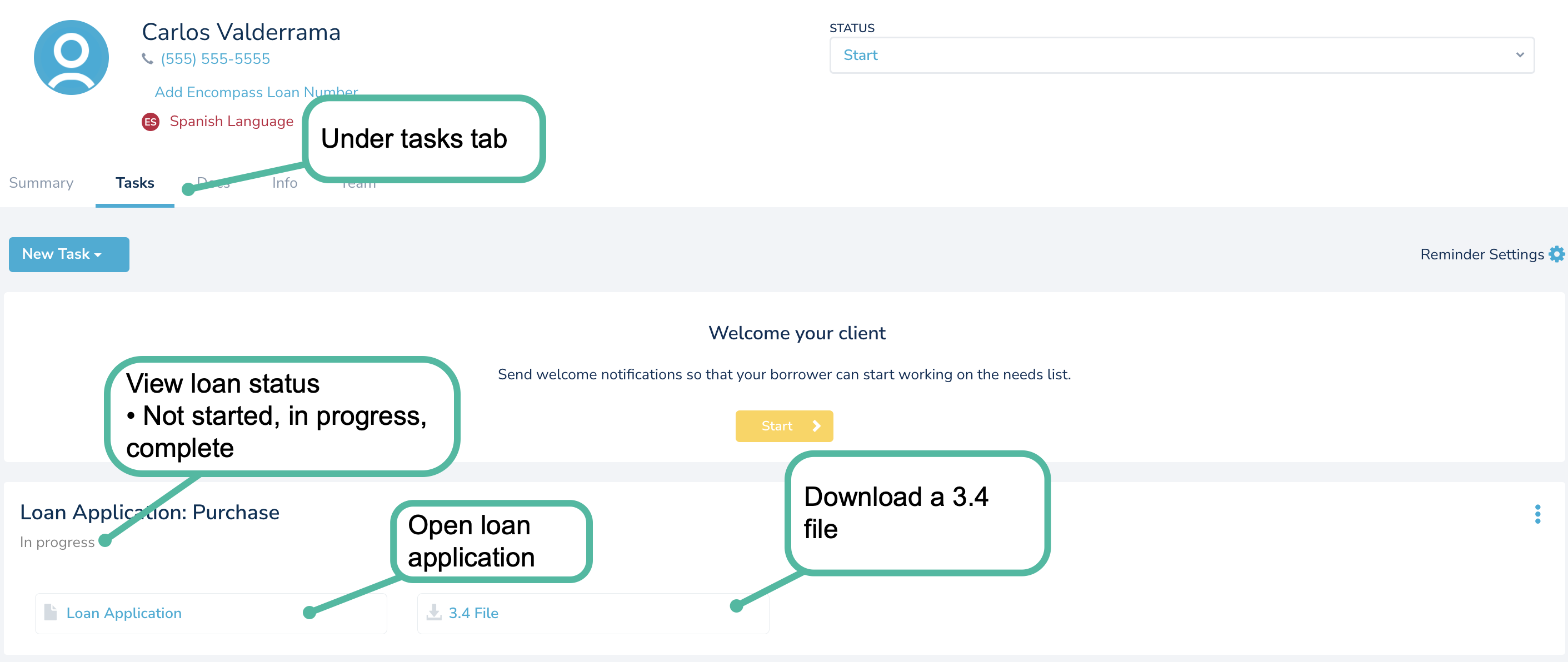

- Go to the loan file for the borrower

- Select the tasks tab

- Click on the Loan Application task and begin filling out the loan application

- If there isn't a loan application task created yet - Go to the New Tasks button and click add task > Enhanced Loan Application

Tip: You can quickly navigate around the Loan Application using either the sidebar or the footer navigation as shown above. Lenders can also submit applications on their borrower's behalf, and can skip questions the borrower would be required to fill out.

Review & Manage Loan Applications

To view a borrower's loan application:

- Open the borrower's loan file

- Go to the Tasks tab

- Find the Loan application task (this could either be under incomplete or completed tasks)

- Click on the blue Loan Application button

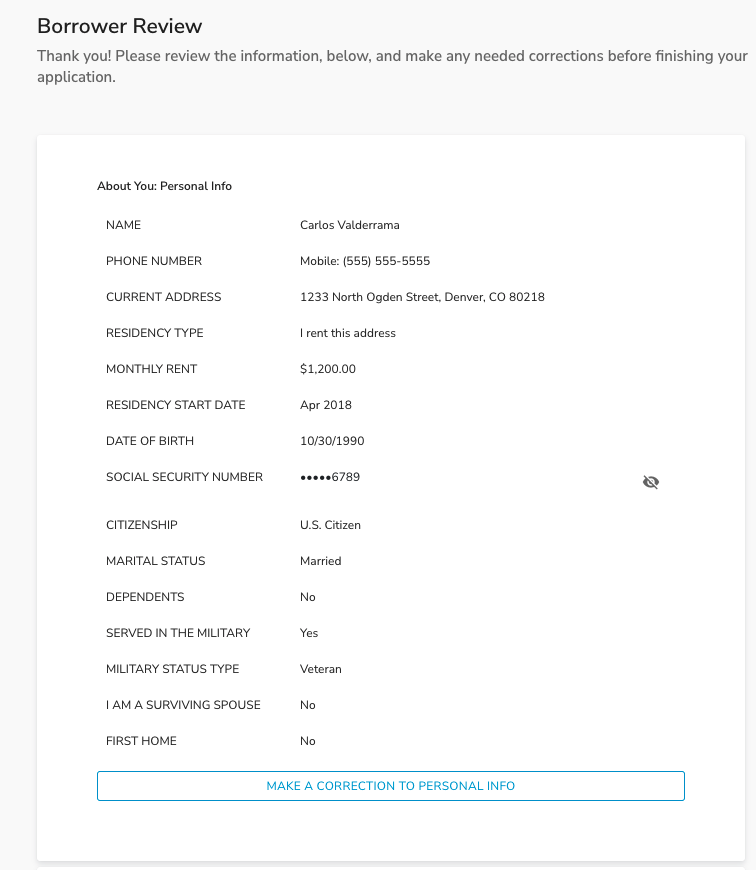

- You will be directed to the borrower review screen where you will see all the borrower's responses.

- If you need to modify the application, click the Make a Correction button for that section, and modify the response on the question

- If you have the borrower's permission (e.g. you are on the phone editing the application with them) you can even submit the loan application on their behalf.

Final Review Section

You will see all the borrowers' answers summarized on the review screen, if you need to revise any of their responses you can do so by clicking on the button to make a correction to info.

The Co-borrower Experience

We updated the co-borrower experience in our Loan Application order to:

- Enable co-borrowers to complete their own sections of the loan application and to complete any follow-up tasks.

- Allow borrowers to decide if they would like to share financial and personal information with their co-borrowers or if they would like to partition that data and keep it private.

- Ensure that each borrower provides their own explicit authorizations for intent to apply for joint credit and use of electronic documents and signatures to comply with ECOA, the E-Sign Act, and CFPB standards.

- Lay the foundation for Maxwell to add multiple co-borrower support in the future.

To learn more about how co-borrowers interact with the application, please click here.

Spanish Applications

For organizations that serve borrowers who speak Spanish as their first language, we have an end-to-end Spanish-translated application. We recommend this feature for organizations that have resources that speak/write Spanish and can continue to converse with borrowers after the application experience is completed.

To learn more about the Spanish Application experience, click here.

FAQs

Can two co-borrowers have the same email address?

In order to track consent for e-signatures and credit authorization as well as to execute e-disclosures and e-closing, we strongly recommend each borrower has their own email address. If your organization would like to enable co-borrowers to share email addresses we need a letter from your head of compliance acknowledging you wish to enable this feature. Shared email support is unavailable for users of our Encompass Disclosures integration.

Can we create custom templates?

Your organization admins can build custom templates for your branch or group. Please reach out to a manager or admin on your account to customize your application experience.

Can we add multiple co-borrowers to a loan application?

Multiple co-borrower support is on our roadmap but does not have a timetable for implementation

Can a borrower submit their application with required questions and missing responses?

No, any time a borrower is missing responses to a required question they will be redirected to the section they are missing answers to complete the application.

A lender can submit a borrower's application with missing fields after acknowledging there are required fields missing in the application.