Week of June 27th

Bugs & Code Cleanup

- Sunset Maxwell Processor Edge feature on June 30th

- Resolved an error where borrowers not sharing finances settings weren't being acknowledged on LO-created loan files

- Resolved an issue where USAA borrowers attempting to connect to FileFetch were getting an incorrect account connection failure email.

- Updated tax return SmartTasks and tasks templates to reflect the time period of the last two years

Week of June 20th

Bugs & Code Cleanup

- Updated with CreditPlus credit reporting agency login credentials and updated name to Xactus

- Fixed bug so that all HMDA demographic information would go to Byte in Loan Application syncs

- Fixed a bug to allow managers to connect DocuSign accounts for their LO's pipelines

Week of June 12th

Features

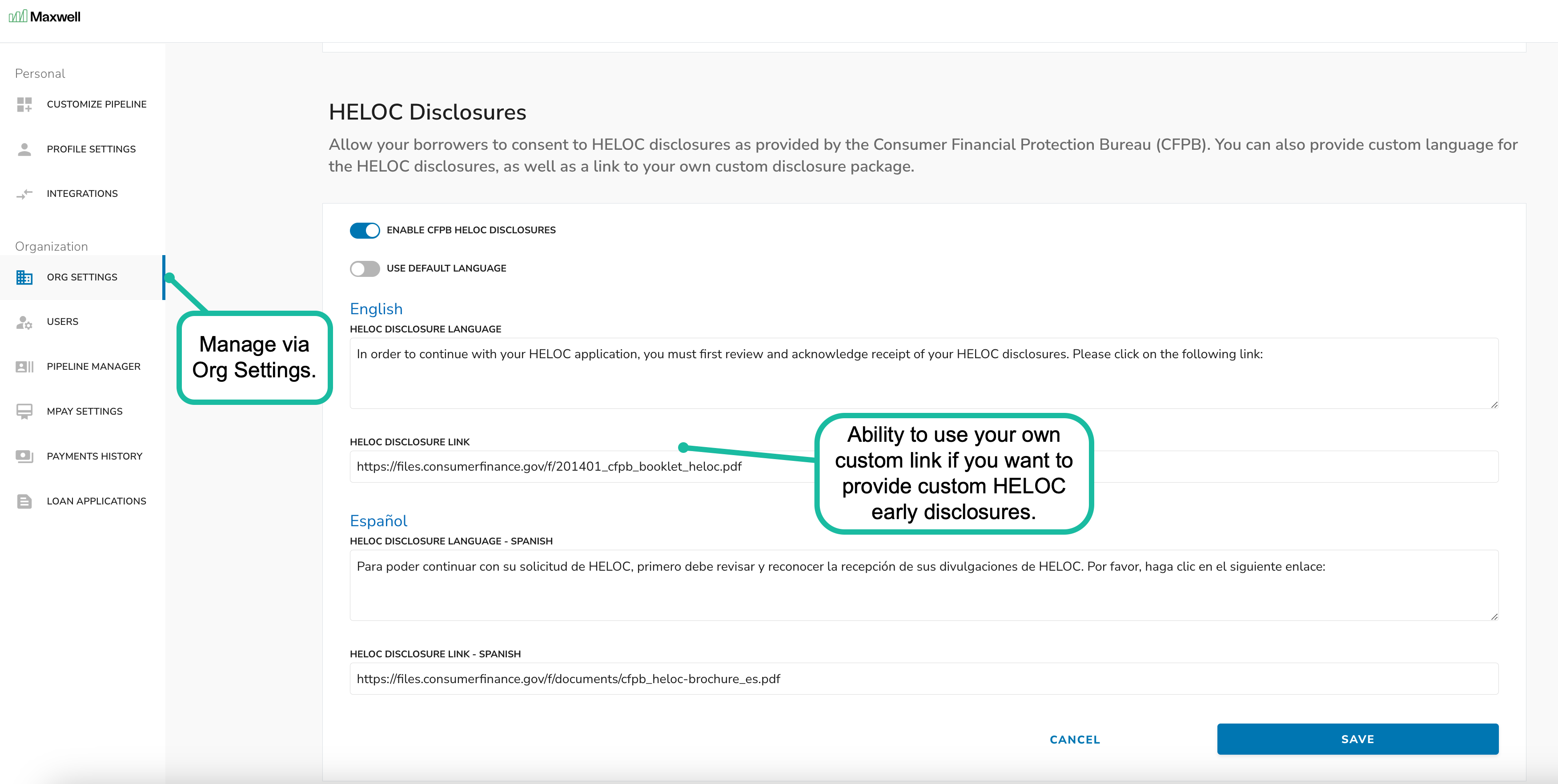

HELOC Early Disclosures

We added a setting for organizations that are using HELOC applications to share Early HELOC disclosures at the time of the application. When this setting is turned on, the borrower will receive a prompt to review and acknowledge the CFPB HELOC disclosures prior to submitting their application.

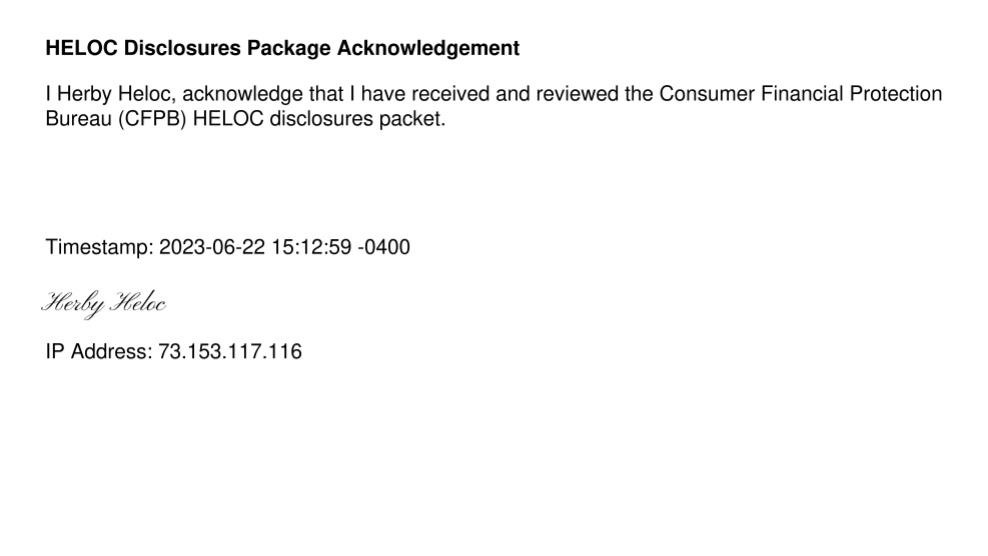

HELOC Disclosures Confirmation

When a borrower provides their HELOC disclosure authorization we generate an authorization form in the doc vault so the lender has a record of the date of acknowledgement.

Configure HELOC Disclosures

By default, we display the standard CFPB HELOC disclosures to the borrower. However, an organization can configure its disclosure messaging and the link for HELOC disclosures if they want to need to include additional HELOC Early Disclosures beyond the standard CFPB packet.

Bugs & Code Cleanup

- Improved failed credit task logging to better identify issues related to failed credit pull connections

Week of June 5th

Features

VOA

- Added the ability to generate a 31-day or 365-day asset report from Plaid VOA tasks (in addition to the 61-day, 91-day and 180-day reports already available). So you can choose the level of transaction history that is appropriate for the borrowers situation. Please note that 365-day reports will have a slightly higher cost associated.

Bugs/Code Cleanup

- Resolved an issue where date of birth month and date fields were getting flipped on some QuickAppply applications.

- Updated pipeline manager sorting so it's done by borrower first and last name so it's easier to find in the lender pipeline