October 25th - November 7th

Features

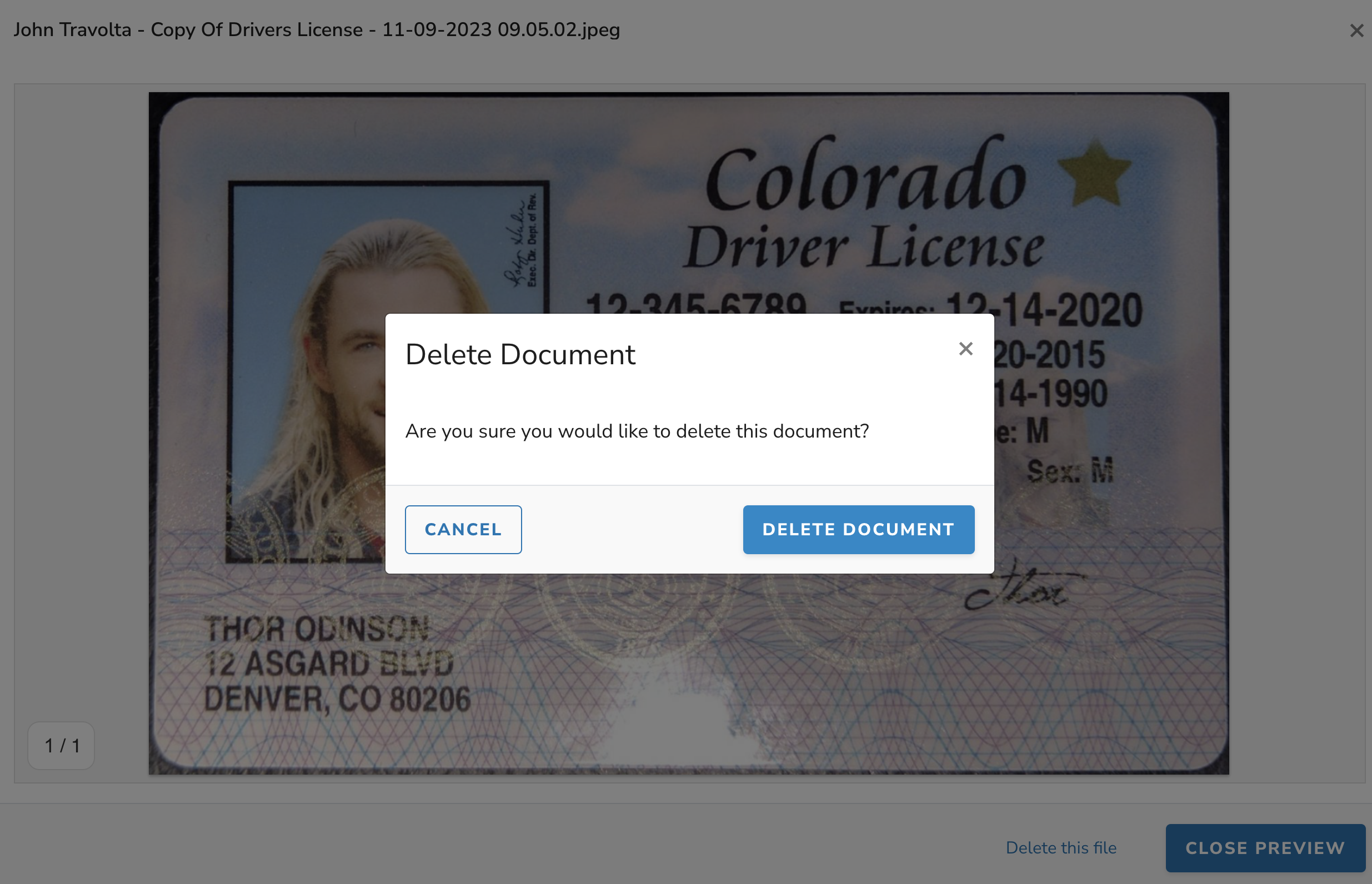

Borrower Tasks - Document Deletion

- We added the ability for borrowers to delete files uploaded to a task. If they click preview document and realize the document is incorrect they can delete the document on the task preview screen. The borrower will asked to confirm deletion so they don't accidentally delete anything important to processing the file.

- Any document that has already sync'd to the LOS based on Lender org settings will remain in the LOS doc folder even if it's deleted in the Maxwell UI.

Bugs / Code Cleanup

- Fixed page crashes if user clicks too quickly between sections in the loan application.

- Fixed a bug where non borrowing owners were being presented application tasks

- For auditing purposes we store old e-consents and credit authorizations in the document vault after a borrowers contact information is updated and a new Borrower Authorization is acquired. That way your organization can reference that you obtained consent from the borrower prior to credit pulls or initial disclosures are issued.

- We improved the page loading speed for borrowers trying to connect to their bank account.

- We updated the mismo spec to use the LOs office phone as opposed to their mobile phone.

- We updated the 3.4 XML download to include application submission date

October 12th - October 24th

Features

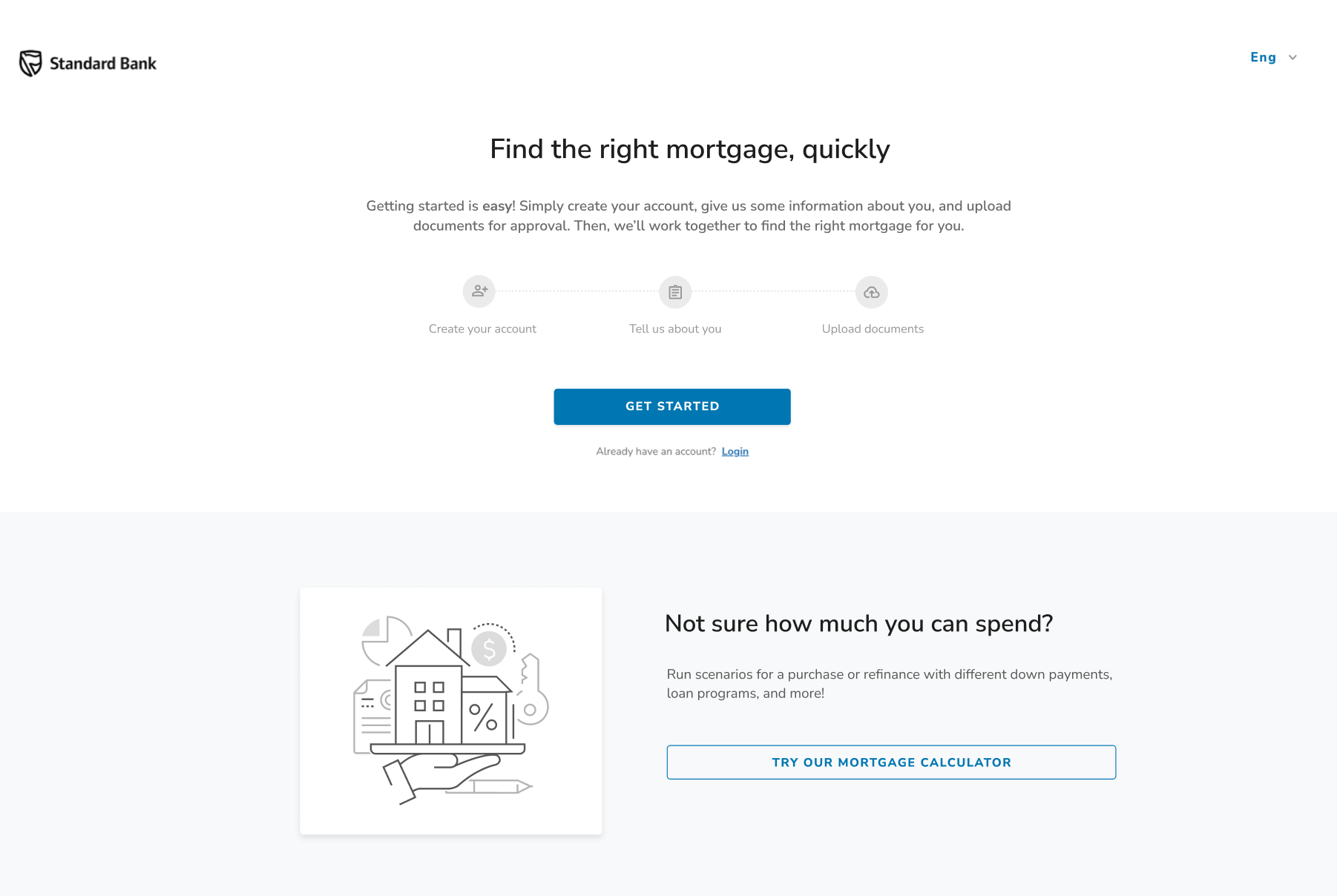

Landing Page Updates

We updated the landing page that borrowers will visit when starting their loan applications. The overall goal is to improve the conversion of borrowers who reach the landing page to begin applications. A few specific improvements we made in this update:

- A clearer hierarchy of the call-to-action buttons to increase borrower application starts

- Improve the layout for mobile & responsive device design

- Updated graphics to add more whitelable configuration and branding for your organization

Bugs / Code Cleanup

- Fixed a bug where the e-consent authorization form was not generated for the borrower if they provided a Verbal Credit Authorization during the loan application. Now the borrower will always be prompted to provide their e-consent on the first login to the POS even if Verbal Credit Authorization was received during an interview application.

- Fixed a bug so a borrower cannot access a loan file is archived. Instead, they will be directed to their home screen and be prompted to start a new loan application file or contact their LO.

- Updated the email notification sent to Non-Borrower Owner (Title only) loan file participants so it does not indicate that they are a borrower on the file.

- Various layout and responsive design updates

September 28th - October 11th

Features

Borrower UX Available to All Customers

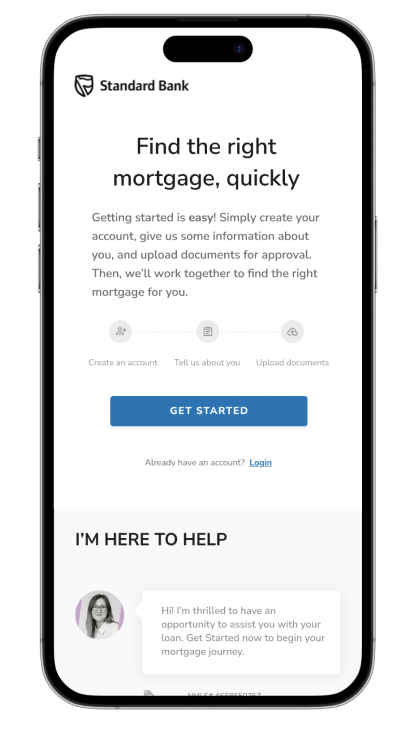

On October 11th, we migrated all organizations over to our New Borrower User Experience. This update is designed to streamline the document collection process and improve borrower pull through rates. We did this by focusing on a few key experiences:

- Mobile-first design: 52% of borrowers are logging in via mobile devices. We designed our new borrower dashboard and tasks experience for a smoother task completion experience regardless of device.

- Improved first-time task completion rate: Clearer task descriptions and helpful borrower tips improve borrower understanding of requirements and reduce churn caused by document rejection on tasks.

- Escalating top borrower priorities: We’ve updated task prioritization and notifications to elevate time sensitive items like disclosures and overdue tasks so it’s clear to the borrower which action items are the highest priority to complete.

In this release, we added a few incremental features to bring our borrower experience to parity with our Classic Borrower UX. These tasks will effectively behave the same as the classic experience, but have been updated to a new mobile view.

- Disclosures tasks

- VOA tasks through Plaid

- VOE/I researched verification

- Updated default task descriptions

Other Borrower UX Updates

- Doc upload naming convention - We updated the naming convention fo for all files uploaded so it is easier for Lenders to find and organize files in their document vault folders. We use the naming convention: firstname_lastname_taskname_uploadNumber_date_time

- Friendly email forwarding – We updated the task reminder email links to forward the borrower directly to the associated open task items that need to be completed.

Encompass TPO Connect (TPOC) Support

Encompass TPO Connect (TPOC) customers can now sync files to/from the Maxwell Point-of-Sale automatically.

- TPO Loan Officers can use their Encompass TPOC email to log into the Maxwell POS

- Loans submitted through the Maxwell POS will be associated with the appropriate External Organization in Encompass, and appear inside the TPOC pipeline for the TPO Loan Officer.

- If a loan is added through TPOC, the loan can be auto-imported into the apporpriate pipeline in Maxwell for borrowers access.

Bugs & Code Cleanup

- Updated mortgage calculator default rate to reflect 7.5% rate that is closer to the current market average.