Week of September 27th

New Features

Screen Share

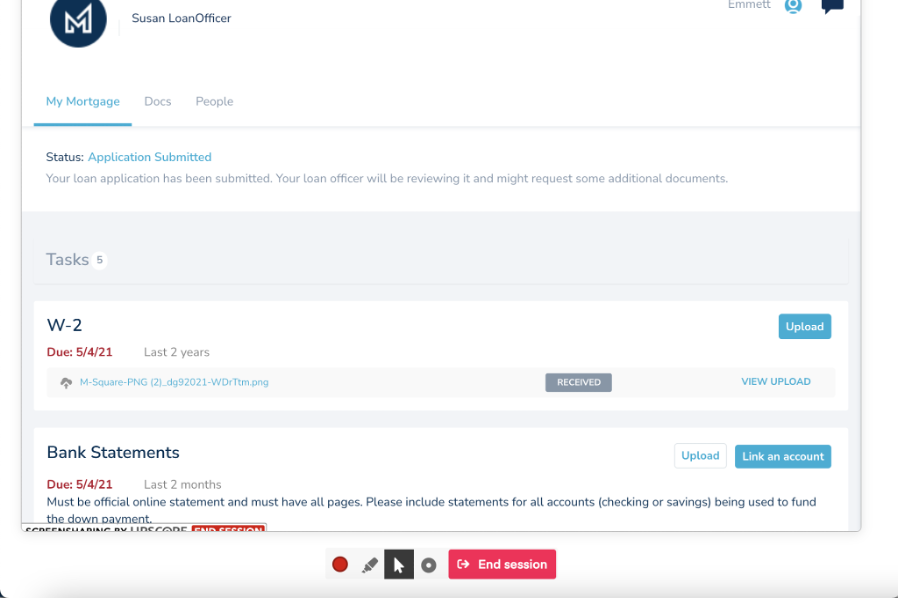

With permission from the borrower, lenders can new view the borrower’s browser screen and assist them in navigating the website.

Using controls below the screen share window, lenders can highlight areas of the screen or even click and scroll for the borrower. The borrower can see the lender’s cursor on the screen, making collaboration simple and confusion-free.

Unlike competitor tools, Maxwell screen share allows lenders to navigate the entire point-of-sale application, including the loan application, borrower tasks, and documents. That means lenders can assist at any point of the borrower experience.

Initiating Screen Share

To start a screen share session with a borrower:

- Open any loan file inside the Maxwell point of sale.

- In the top-right corner of the screen, click Share Screen. A new tab will open.

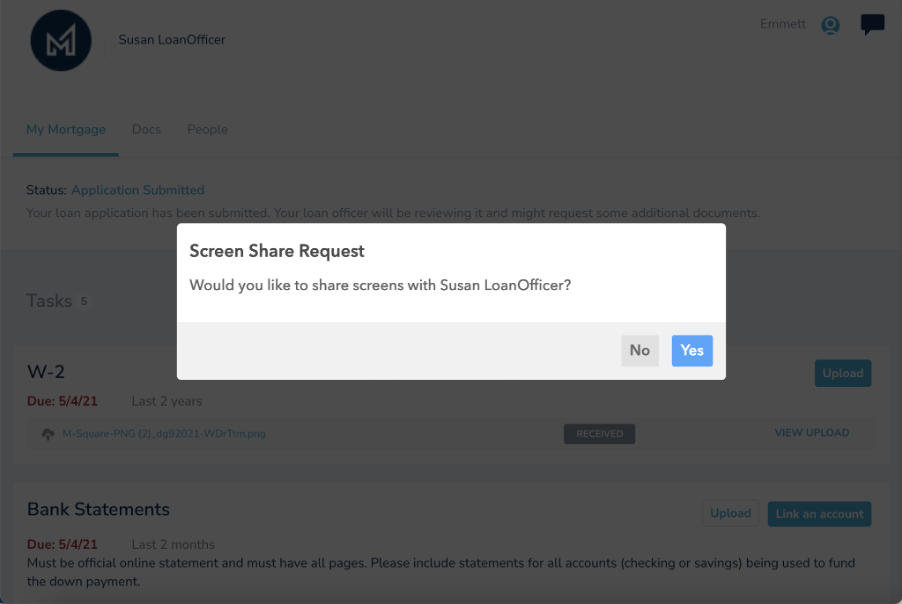

- In the new tab, select Send Request.

- The borrower will then be notified of the screen share request. They must confirm that they wish to share their screen with the lender.

After the borrower confirms, the lender will see the borrower’s screen. Either the borrower or lender can end the screen sharing session at any time using the on-screen controls at the bottom of their screen.

FAQs

What does this cost?

The screen share functionality is available at no additional cost to you as a way to assist borrowers and progress loans more quickly.

Who has access to request a screen share?

Screen share is available to any lender (loan officer, processor, loan officer assistant, or manager) with access to a loan file.

What if a borrower is not online?

The borrower needs to be logged into the application. If the borrower is not online when a request is made, the lender will receive a message that the borrower is not currently online.

Can screen share be used for any borrower?

Today, screen share can only be used with the primary borrower on a loan file. We plan to extend this functionality to additional borrowers in the future.

Does Screen Share work on mobile devices?

Screen share works exceptionally well when the borrower is on a mobile device. The lender will see the borrower’s mobile view and can annotate, click, and scroll without issue.

When a lender is on a mobile device, screen share can be initiated and the lender can view the borrower’s screen. However, navigation may be difficult because of the nature of the smaller screen and mobile gestures. For the best experience, we recommend the lender use a desktop browser when attempting to control a borrower’s screen.

Does screen share work in incognito/private browsing modes?

Yes, screen share can be used when a borrower is in incognito/private browsing mode in their browser.

Is anything captured or recorded during a screen share session?

No, nothing is ever captured or recorded, and the integration works in accordance with our SOC II security standards.

Known Limitations

- Screen Share currently only works with primary borrower on a loan file. It cannot be used with co-borrowers today.

- Screen Share does not display screens while a borrower is connecting to their financial institutions, such as in FileFetch or Verification of Assets tasks.

Feature Enhancements

QuickPricer

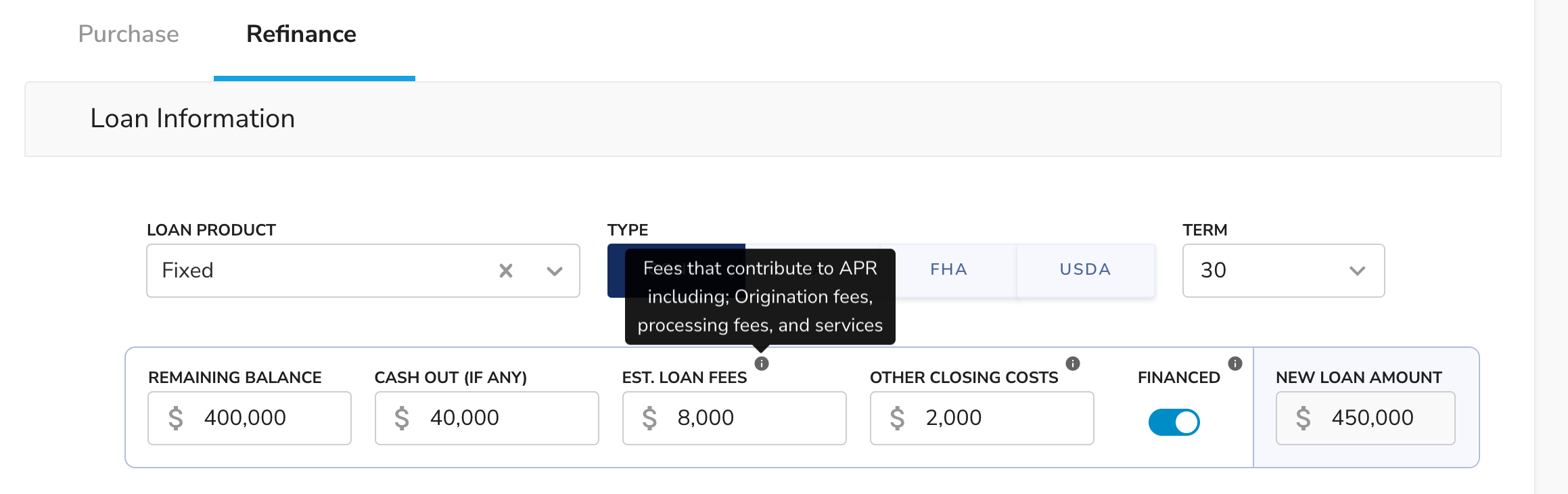

- Broke apart Lender Fees and Other Closing Costs into two separate fields to break apart which closing costs will be applied to the APR calculation and added tool tips to explain which fees to include in each area.

Lender Dashboard

- Added Resend Invite button into status column for Borrowers who haven't yet logged in after their initial invitation. This button takes the Lender directly to the send welcome email screen.

- Tightened Search results so fewer loans return when there are exact matches.

- Added a Loading Indicator to the lender dashboard table for lenders who have very large pipelines that require a few moments to process table updates.

- Increased the size of the Documents to Review Badge & Number to make it easier to read

- Updated links so you can right click and Open Loan File links as a new tab

Encompass Disclosures

- Added additional messaging and checks for Chrome Incognito and Firefox Private Browsing modes, providing additional context and instruction for the borrower

Bug Fixes

- Removed HTML characters from QuickPricer borrower shared scenarios

- Miscellaneous bug fixes and performance enhancements

Week of September 20th

MeridianLink Mortgage Enhancements

- Files that are uploaded to a task before syncing the loan file with MeridianLink Mortgage are now automatically uploaded (if auto-uploads are enabled).

Bug Fixes

- Fixed an issue that caused some document uploads to remain stuck in the "sending" status when trying to sync with an LOS

- Fixed an issue which could result in the same team member being assigned to a team multiple times.

- Miscellaneous bug fixes and performance enhancements

Week of September 13th

Bug Fixes

- Miscellaneous bug fixes and performance enhancements

Week of September 6th

New Features

MeridianLink Mortgage: Auto-Team Syncing

We’ve rolled out a new feature that automatically assigns team members to loans through MeridianLink Mortgage. This change will improve how team members are managed inside Maxwell and will strengthen our integration with the MeridianLink LOS.

What this means for you and your team

Loans in Maxwell will be assigned to users based on team assignments in the loan in MeridianLink Mortgage.

Operations Managers will no longer need to manually assign team members to teams or loan files inside Maxwell. Simply create a user in Maxwell using Organization Settings, and Maxwell will assign that user based on activity in MeridianLink Mortgage.

Loan Officers won’t have to launch MeridianLink Mortgage to find the assigned Processor or Loan Officer Assistant. Instead, the Maxwell platform will make clear who is actually working the loan. That means all teammates will gain access to borrower tasks lists, documents, loan notes, and other shared features.

Maxwell Processors, Loan Officer Assistants, and Managers will be able to easily find the loans that matter. Maxwell will assign loans automatically, ensuring clean pipelines that are aligned to what displays in MeridianLink Mortgage.

Borrowers will see the right team member assigned to each loan file, keeping the borrower team list clean and accurate.

How it works

- Maxwell tracks team assignments inside MeridianLink Mortgage whenever you push a new loan from Maxwell.

- When Maxwell sees a new team member assigned in MeridianLink Mortgage, it will check whether that user has already been added to Maxwell.

- If there is a match, Maxwell will automatically assign that user as a team member in Maxwell. You can view these team members in the "Teams" tab of a loan file inside Maxwell.

- If a team member is removed or reassigned in MeridianLink Mortgage, Maxwell will track that too, and remove/reassign the team member from Maxwell.

QuickPricer

Updated Layout to QuickPricer Calculator

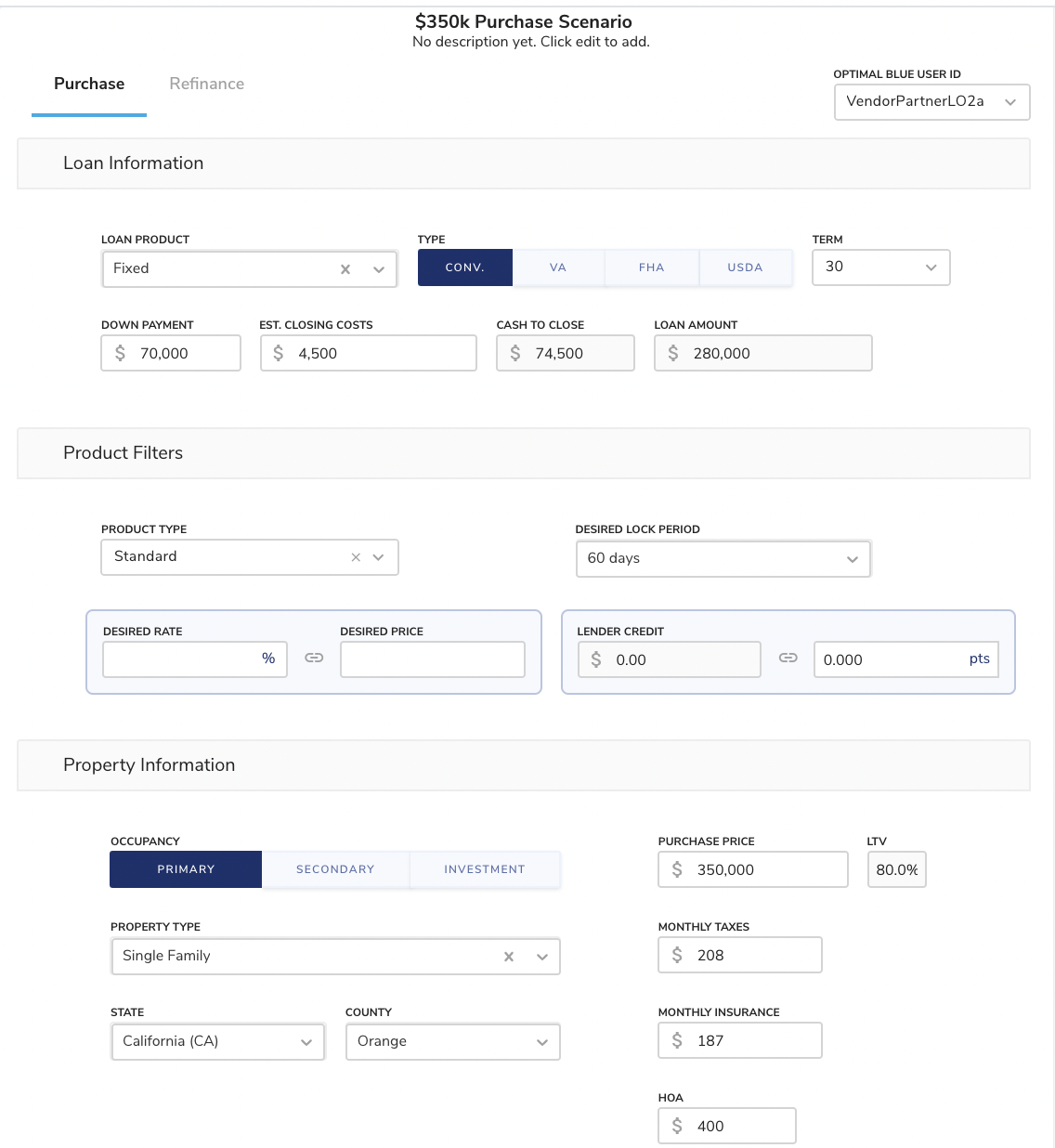

- Improved layout for mobile and tablet experience

- Added headers for navigation

- Other user experience updates to improve readability and navigation like fonts, icons and colors

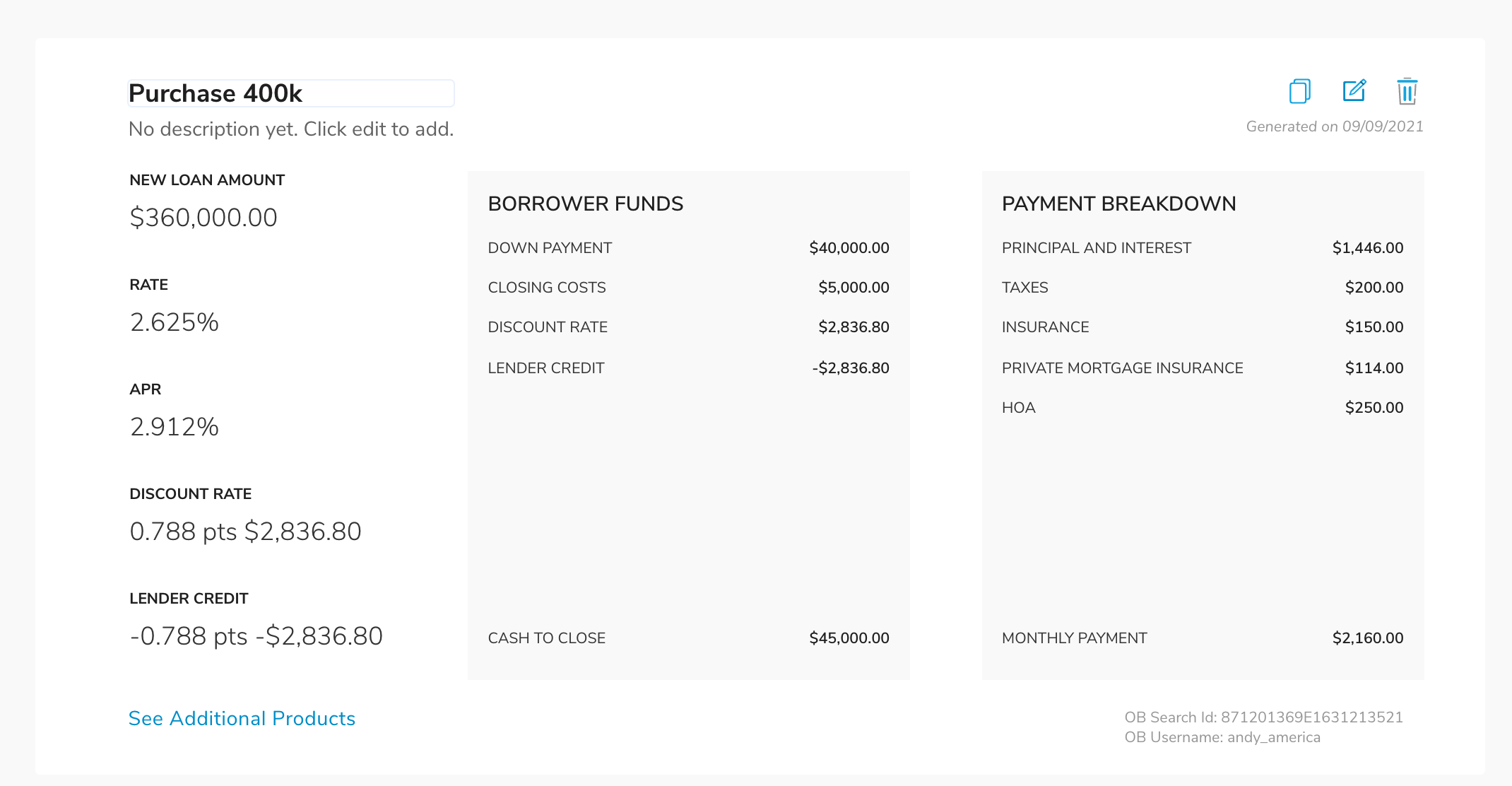

Include Discount & Rebate Calculations in Lender Scenario Card

Updated the lender scenario card to clearly display the dollar values attributed to Discount, Rebates & Lender Credits

Updated Fine Print Disclosure on Borrower Scenario Card

Updated fine print to provide lenders a little more coverage that rates and values are not final and that loan information needs to be verified and qualified.

Actual values and rates may change once borrower and property information have been verified and qualified.

Added Delete Confirmation to QuickPricer Scenario

Added a double confirmation so users don't unintentionally delete a pricing scenario.

Bug Fixes

- Bug fixes for the Enhanced Loan Application (Beta)