Week of August 30th

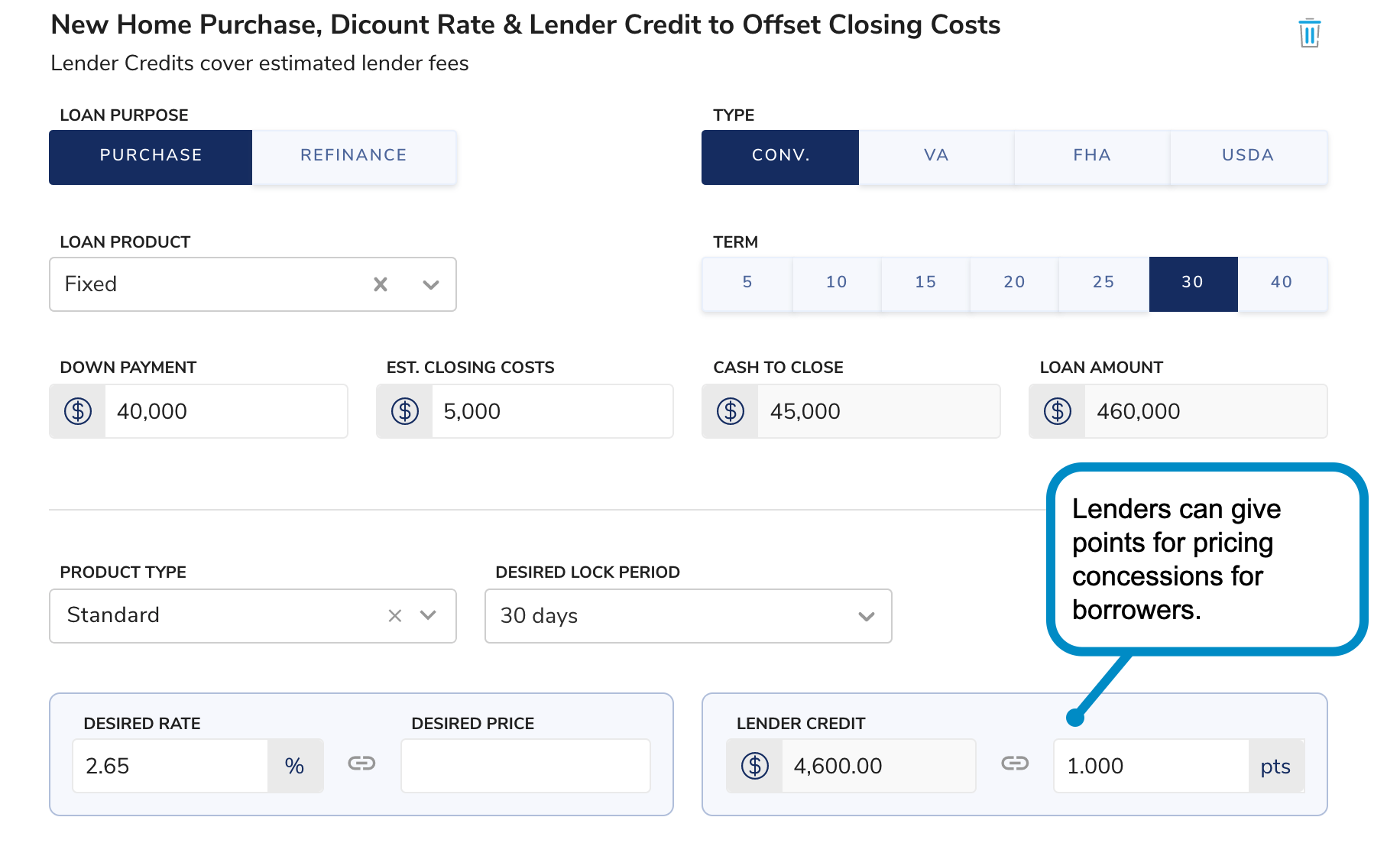

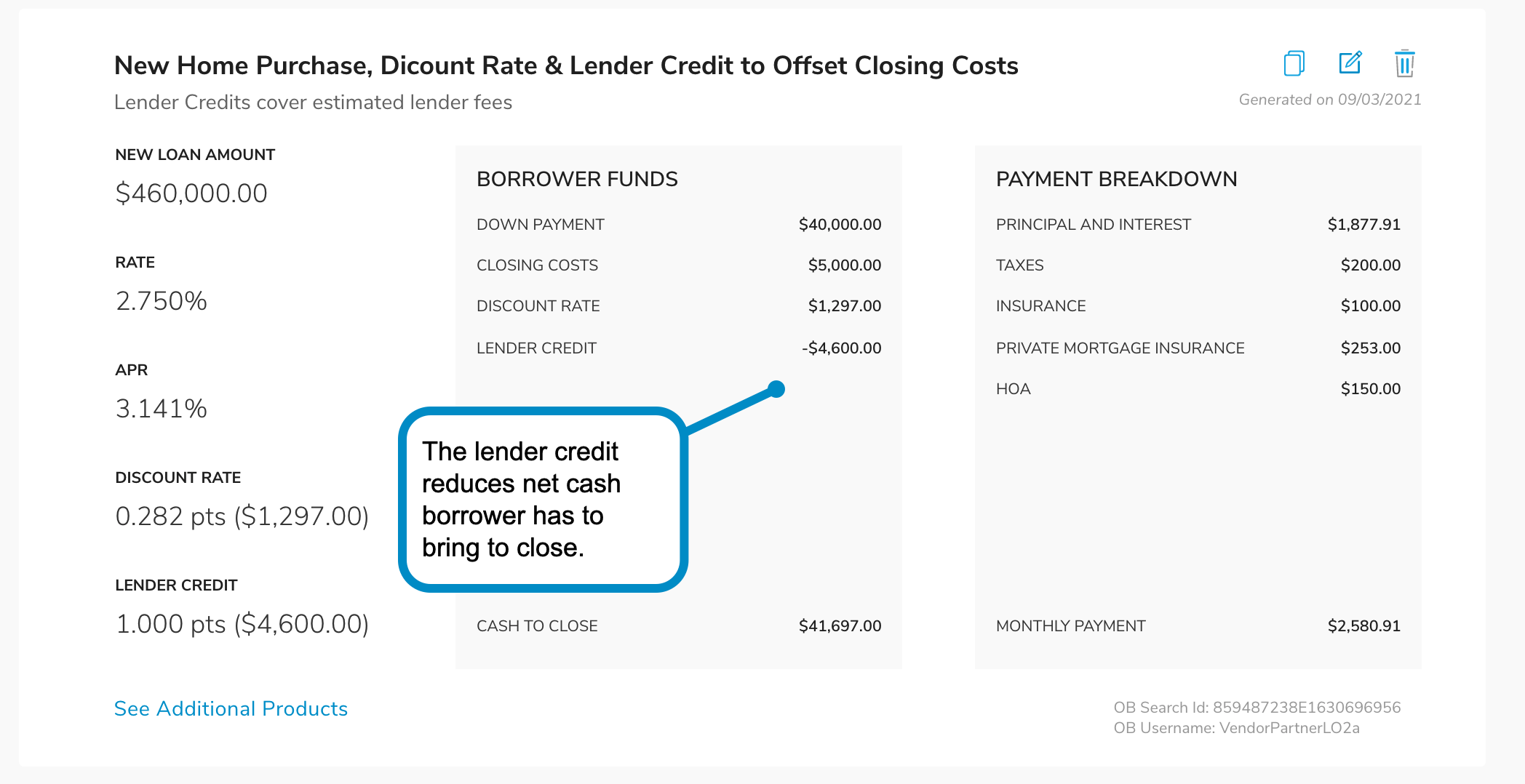

QuickPricer

Maxwell's continues our updates to the QuickPricer tool

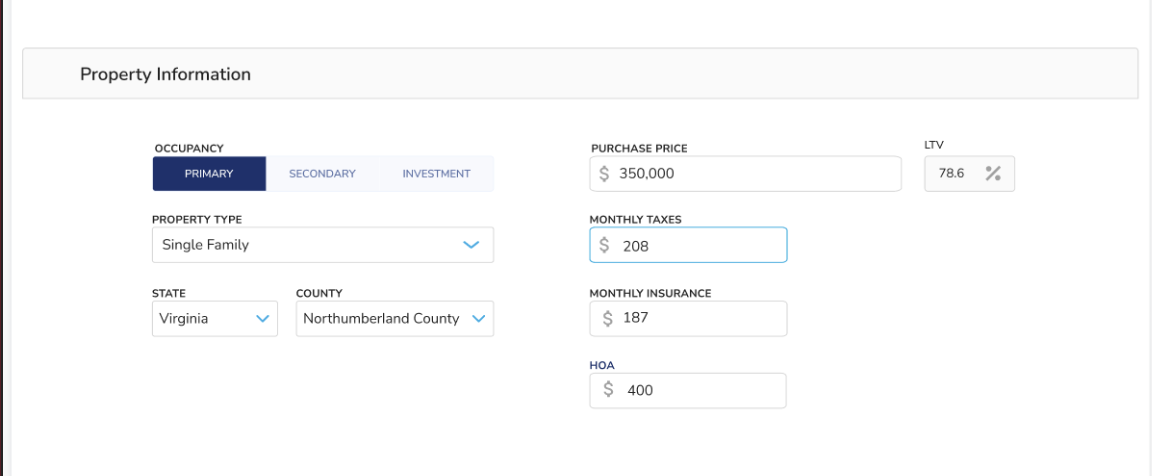

Lender Credit Field – Allows the lender to add a points concession to their pricing scenarios.

Broke apart Taxes, Insurance and HOA Dues for Monthly Payment Breakdown - Split apart the inputs so the lender can transparently show the monthly payment breakdown to borrower.

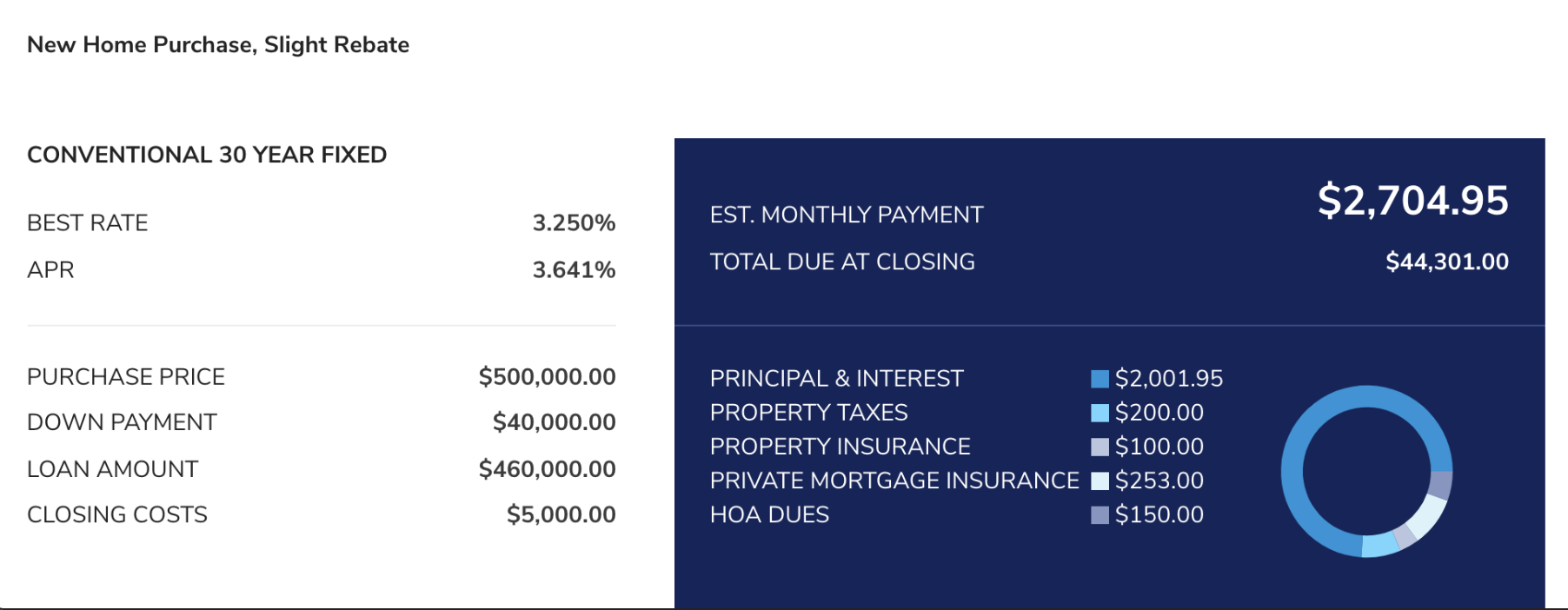

Updated borrower scenario cards - We improved the look and feel of what lenders share with borrowers to make it easier for the borrower view and compare the differences between loan scenarios.

Bugs

- Fixed an issue that prevented the Encompass disclosure tab from opening. This primarily affected the Safari browser, which treated the disclosure tab as a pop-up.

- Other miscellaneous bugs and scaling enhancements.

Week of August 23rd

New Loan Application (Beta)

Maxwell's new loan application was rolled out as an opt-in beta. Contact your customer success manager to opt-in or get a full demo of the new loan application.

Key features:

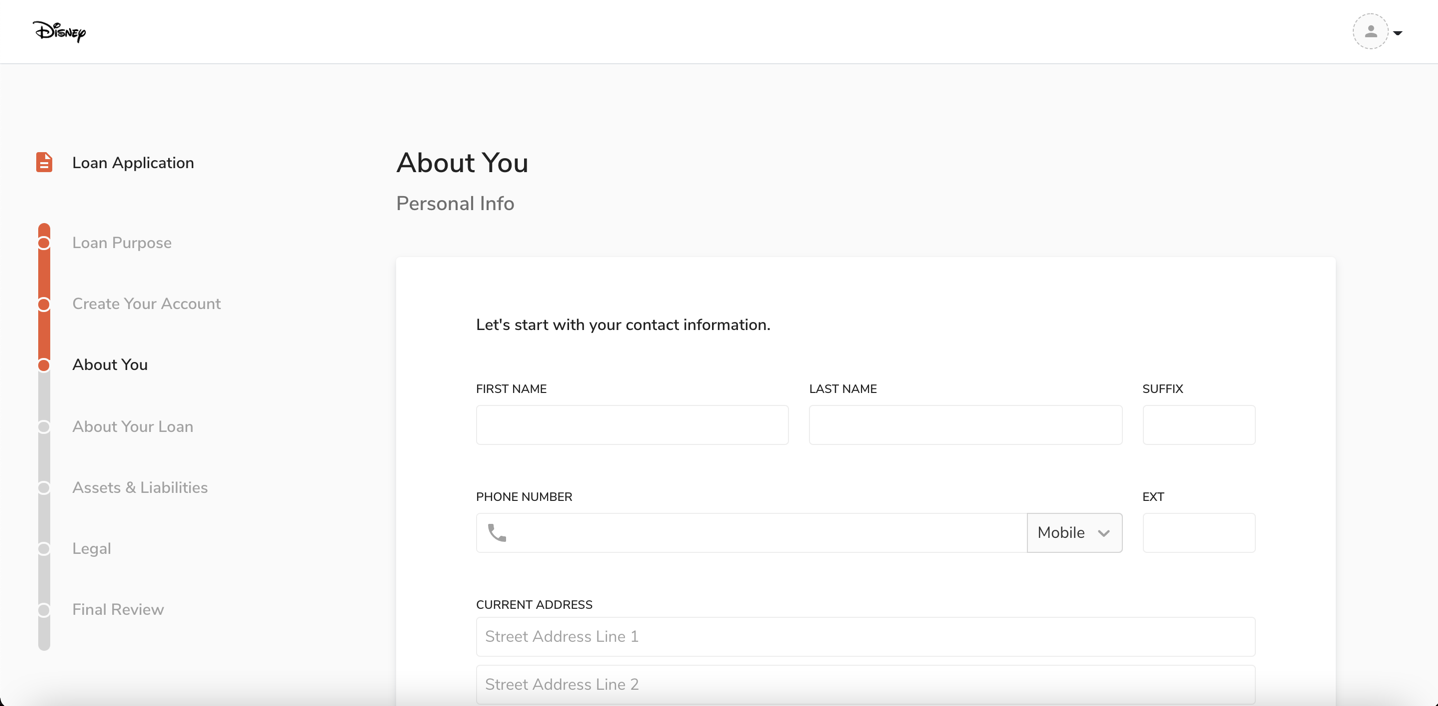

- Wizard-style flow - Our application adjusts behind-the-scenes to each borrower’s unique financial situation, so they only answer questions that are relevant to them.

- Borrower-driven design - We tested multiple application designs on real mortgage borrowers, identified the confusion points for most borrowers, and built our mortgage application to be simple and easy to use

- Customized branding - We’ve designed this application to be fully white label. From your logo and url in the header, to text and button colors throughout the form, your loan application becomes an extension of your brand, bolstering borrower confidence.

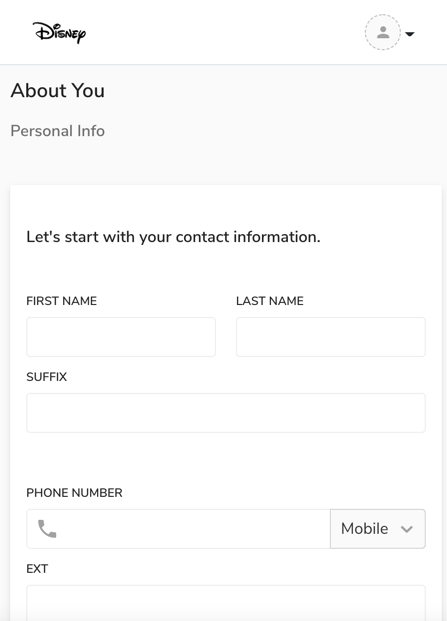

- Simplified, mobile-friendly layout: Our application layout focuses your borrower’s attention on the question they’re filling out while eliminating “noise”, allowing them to complete the form easily on any device

Desktop

Mobile-friendly layout

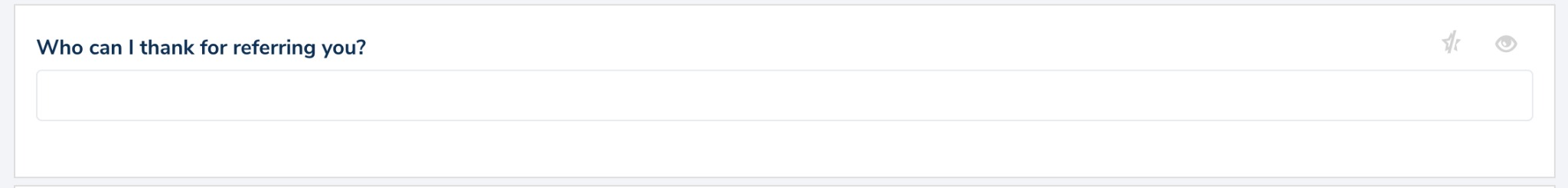

Loan Application Referral Source

Historically, lenders have used a custom question in the Maxwell loan application to capture the borrower’s referral source. This information would then be manually transferred to the LOS or a CRM.

We’ve created a new, optional question specifically for capturing referral source in existing loan applications. We’ve also added this question to our enhanced loan application, currently in beta.

Enabling Referral Source

The new referral source question is disabled by default. It can be enabled in any loan template using the template editor:

- Select “Edit” for the desired loan application template:

- Scroll to the bottom of the “About Your Mortgage” section.

- Look for a hidden question. It will have a crossed-out eye icon:

- Click the crossed-out eye icon to reveal the question:

- Once revealed, the template automatically saves and the question will be added to new loan applications

NOTE: This change could take up to 1 hour to update in new loan application templates.

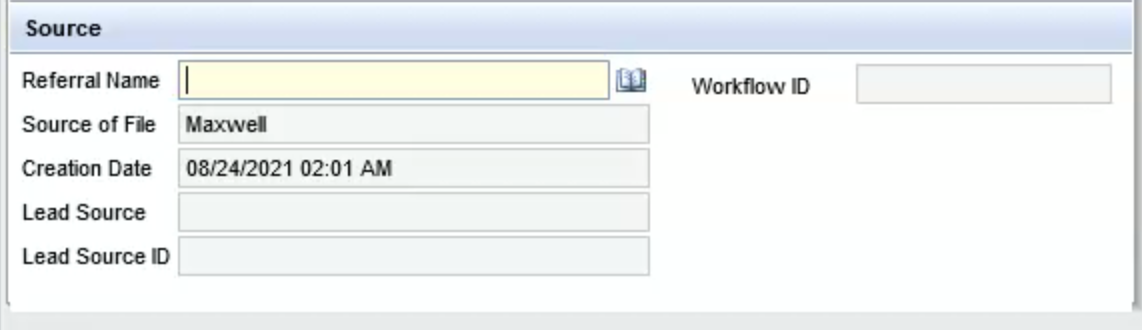

Encompass Integration

For Encompass customers, the referral source will automatically be passed to the “Referral Name” field in Encompass (Encompass field id 1822), highlighted below:

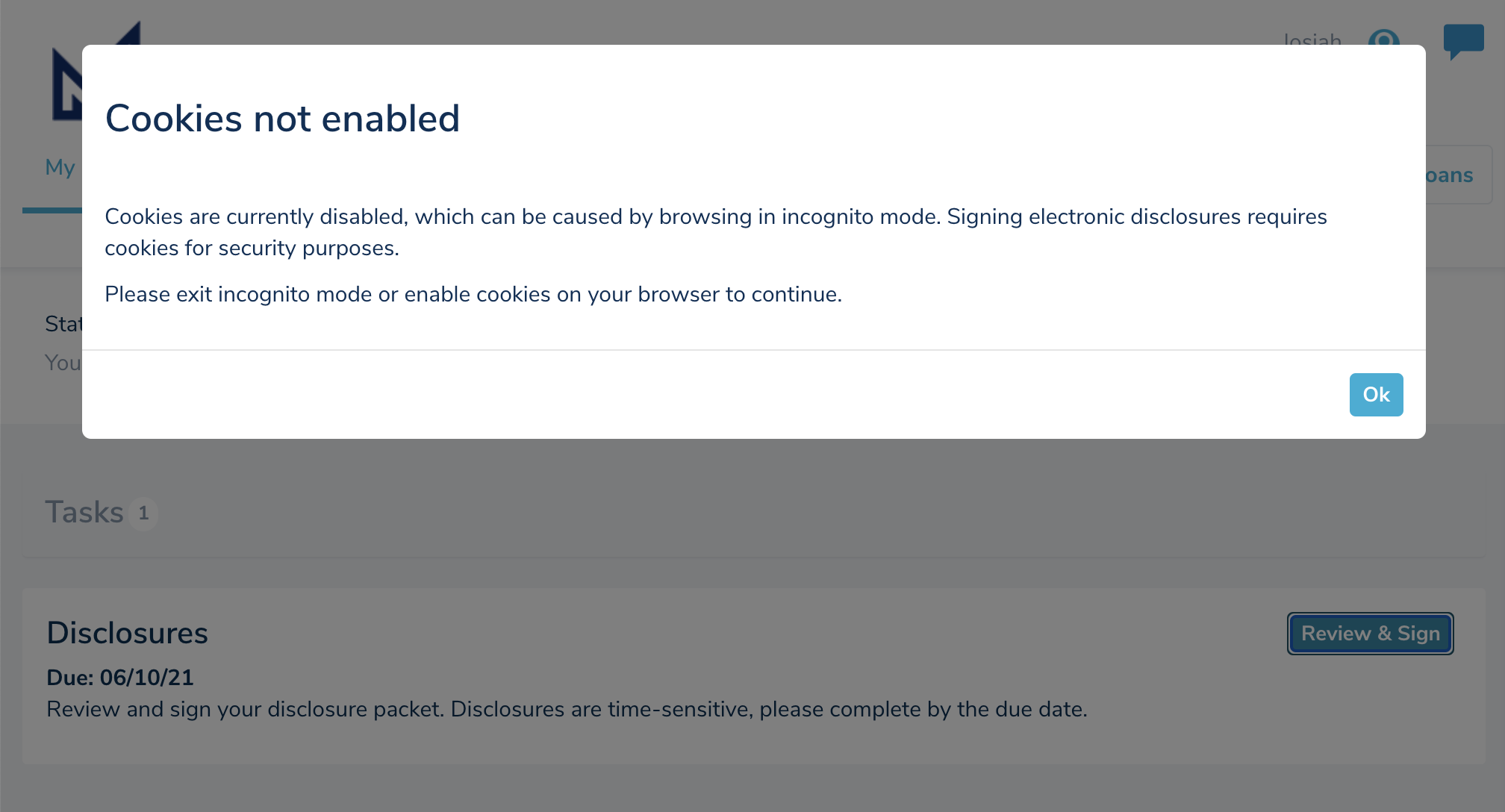

Encompass Disclosures

To prevent borrower confusion, we've added an indication to the borrower if they attempt to sign disclosures in incognito mode or with third-party cookies disabled:

Bug Fixes

- Updated max loans per page to 50 on beta dashboard

- Fixed issue so Reset Filters resets loan files displayed to: all pipelines, all team members, and all open loans

- Added residence start/end dates to MISMO for LendingQB exports

- Fixed ULAD validation for Down Payment when the purchase price field is hidden

Week of August 16th

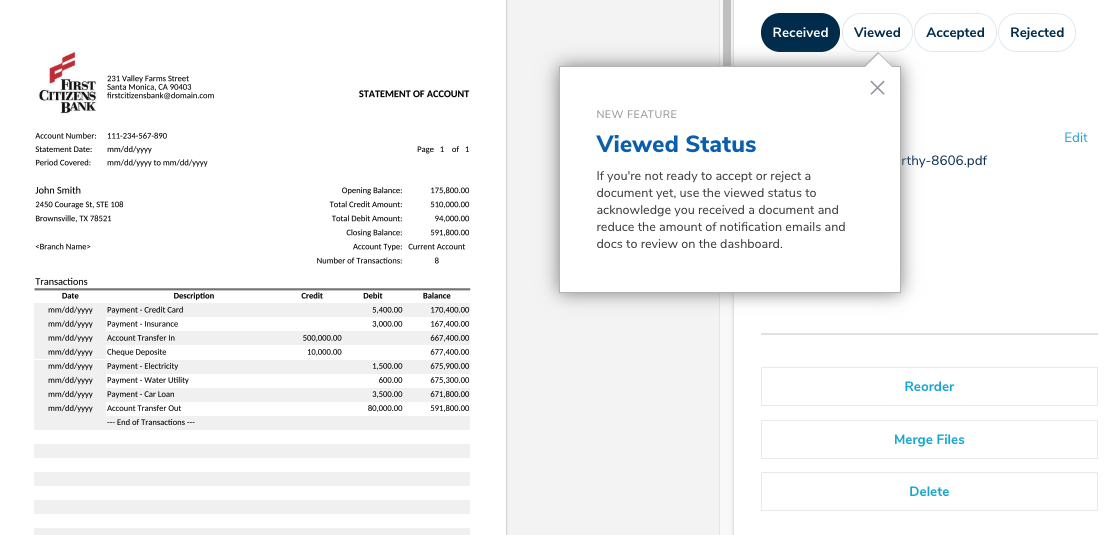

Viewed Document Status

We've added a new status to Document Management called "Viewed"

Many lenders requested an additional status for documents that have been reviewed, but are not yet ready to accept and sync to their LOS. The viewed status allows lenders to acknowledge they received a document from the borrower and reduce the number of notifications emails and docs to review on the dashboard.

To use this feature open the documents view, and select the viewed status button. You must do this manually, it will not change automatically.

Marking Tasks as Complete with Received Docs

Any task that a Lender marks as complete that contains document(s) still in received status will automatically change to viewed, because those documents no longer require review and notifications.

QuickPricer Updates

Financing Closings Costs

In Refinances a borrower has the option to finance their closing costs into their total loan amount and pay them off over the course of the loan. We have added a toggle that allows the lender to include or exclude closing costs in the refinanced loan amount.

.gif)

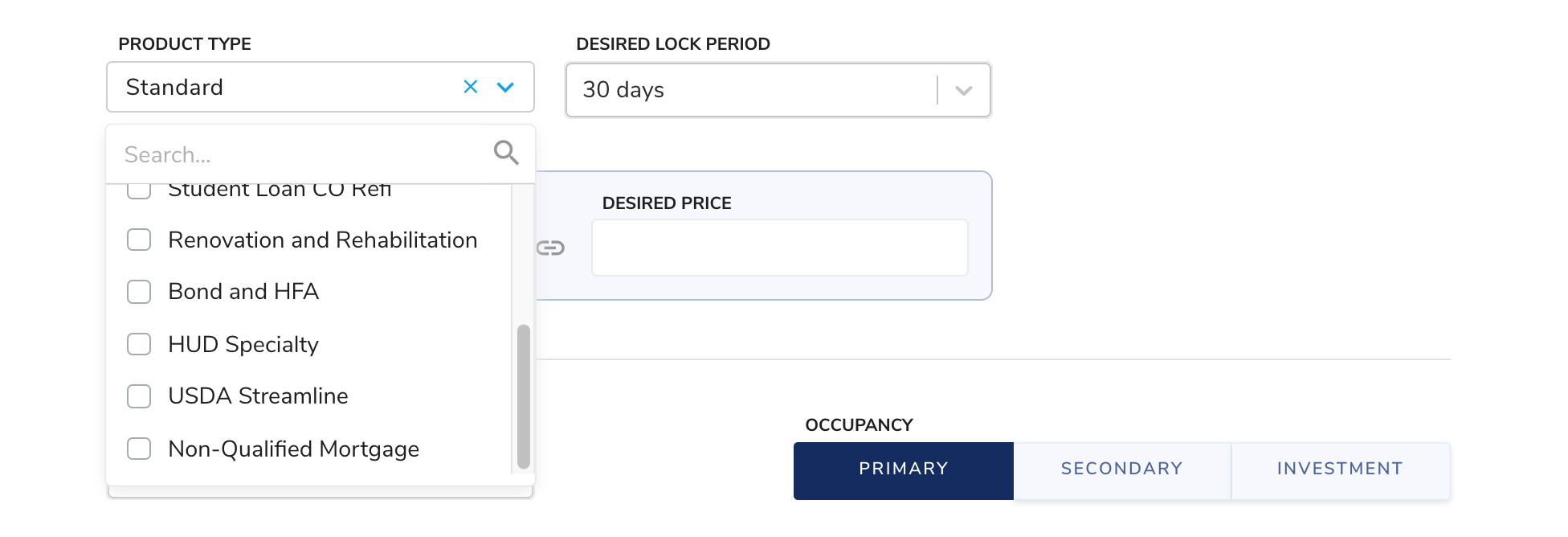

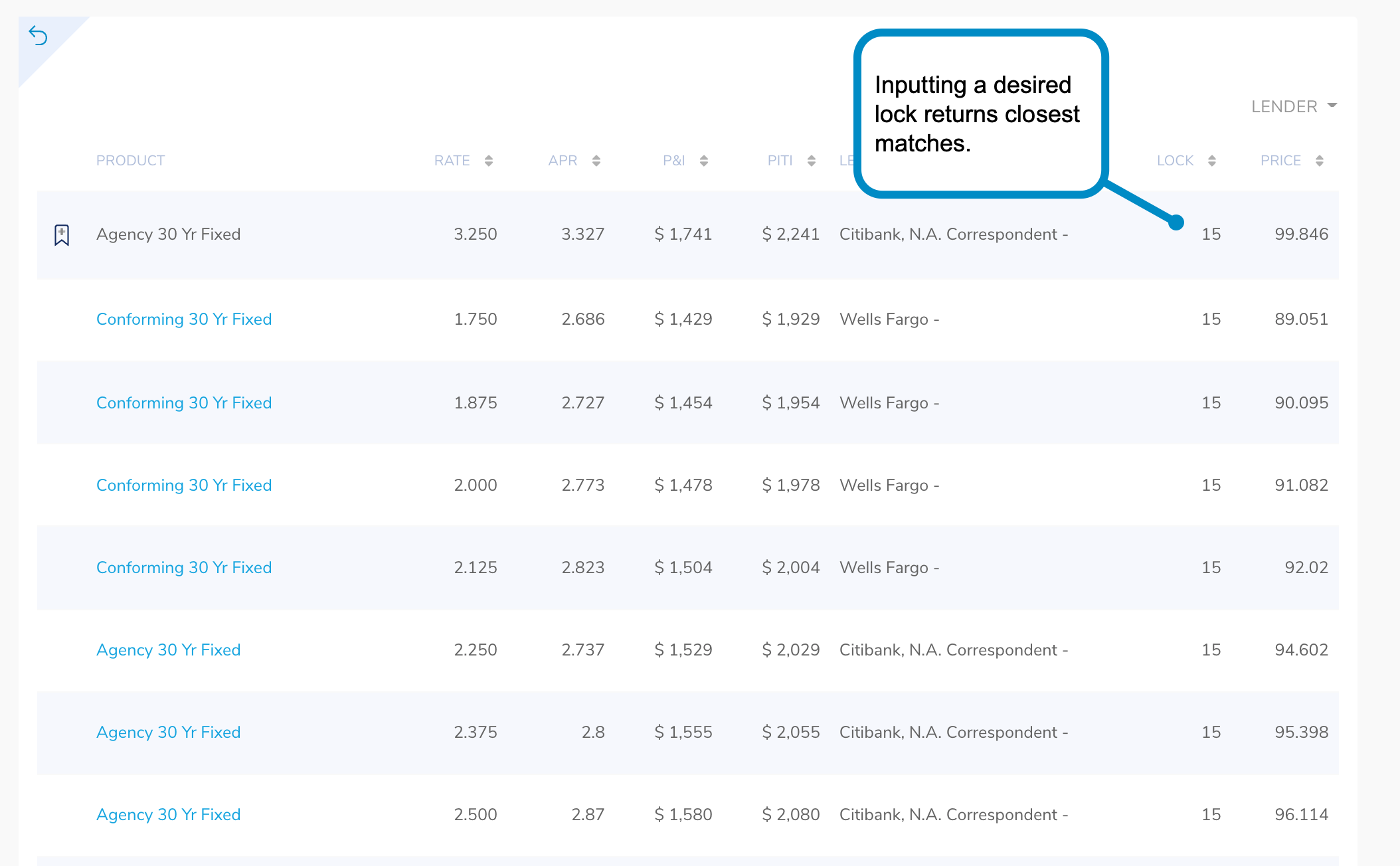

Advanced Filters

We've added several advanced filters to QuickPricer so Loan Officers can narrow in on the best matching product for the client.

- Product Type: Allows an LO to select one or more specific loan types their borrower might qualify for from USDA streamline, HUD speciality, Non QM, etc.

- Desired Lock - Narrows down to products closest to your desired lock period

- Desired Rate or Desired Price: Allows the LO to put in a specific rate or price they would like to target for their loan product. It will return the closet match as the top result.

.gif)

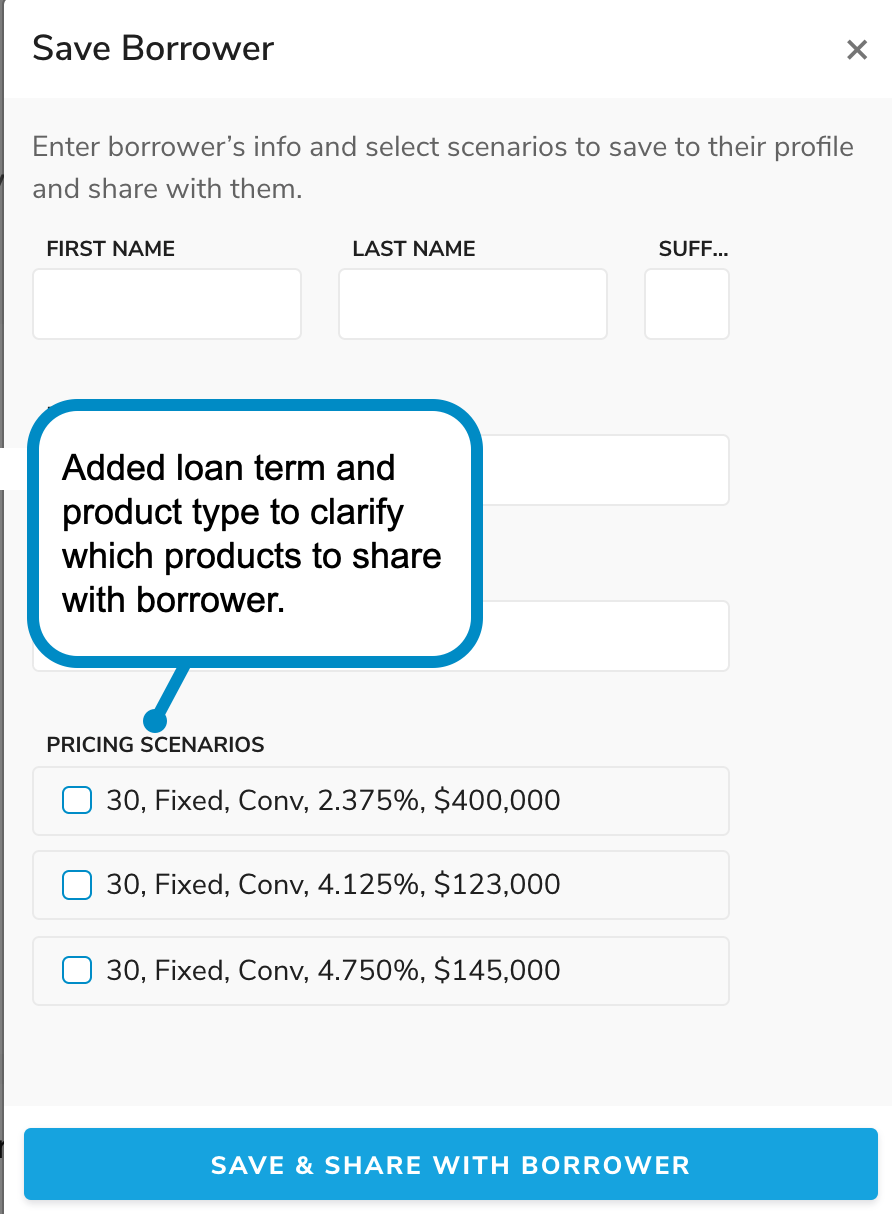

Added Product Type and Loan Term to Sharing Modal

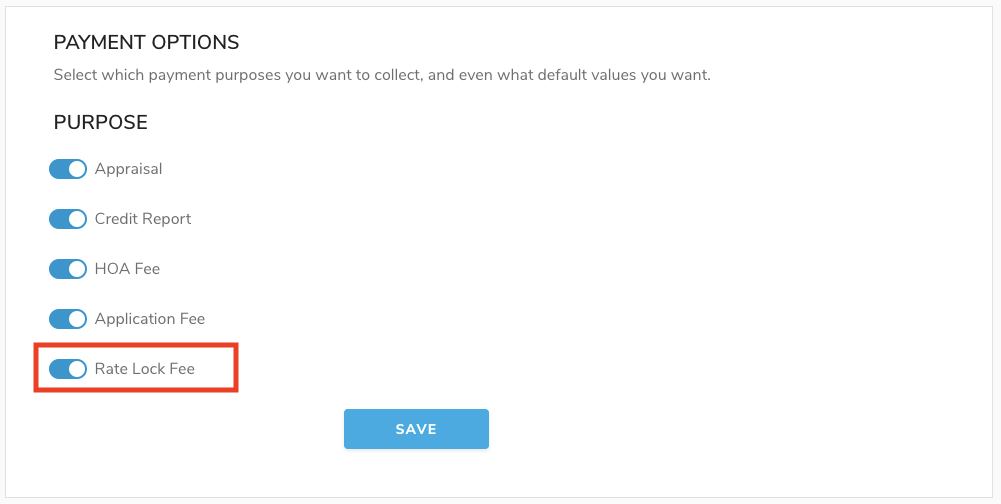

Accepting Rate Lock Fees

We've added a new Rate Lock Fee payment option for MPay. To enable this option for lenders:

- From the user dropdown, select Settings

- In the left navigation panel, select MPay Settings

- In the Payment Options section, click the toggle to enable Rate Lock Fee

- Click Save

Bug Fixes

- Updated number of loans displayed on Beta Dashboard to 50 per page

- We now allow "Select All" pipelines while creating a new user in User Settings

- Miscellaneous bug fixes and performance enhancements

Week of August 9th

Lender Public Phone Number Enhancements

We've updated how we handle mobile phone numbers for lenders:

- We've separated the public-facing mobile phone number from the mobile phone number used for two-factor authentication (2FA)

- Lenders can now remove the mobile phone number on their public communications without affecting their access to 2FA

- While we were in there, we enhanced the UI of the lender profile settings page

Lender Dashboard Enhancements

- Updated search to return results for misspellings and other close results

- Improved the mobile browsing experience

Bug Fixes

- Updated text from "Maxwell" to "Encompass" on the team page for auto-assigned team members

Week of August 2nd

Lender Dashboard Enhancements

- Added auto-save on sorting and filtering so the lender will retain their previous sorting settings when they return to the dashboard

- Added processor pipeline so Loan Officers can see which processors are on a file without opening the teams tab

- Fixed a bug so managers and assistants must select a pipeline prior to importing a loan file from Encompass

Bug Fixes

- Miscellaneous bug fixes and performance enhancements