Week of May 23rd

Enhanced Loan Application

- Made detailed fields in the loan applications like Account #, Employer Address, and Employer Phone never required so a borrower can complete the loan application from memory without looking up details that would be collected in the document collection/processing phase.

Bugs and Code Cleanup

- Fixed an issue where a co-borrower can begin their application as soon as they are added to the file by the Lender in the New Loan File flow.

- Updated connect account button language to "Import from Account" for consistency.

- Fixed bug that was preventing the use of special characters in custom questions answer options

- Fixed bug that was preventing lenders from adding ELA tasks to borrower task templates

Week of May 16th

Enhanced Loan Application

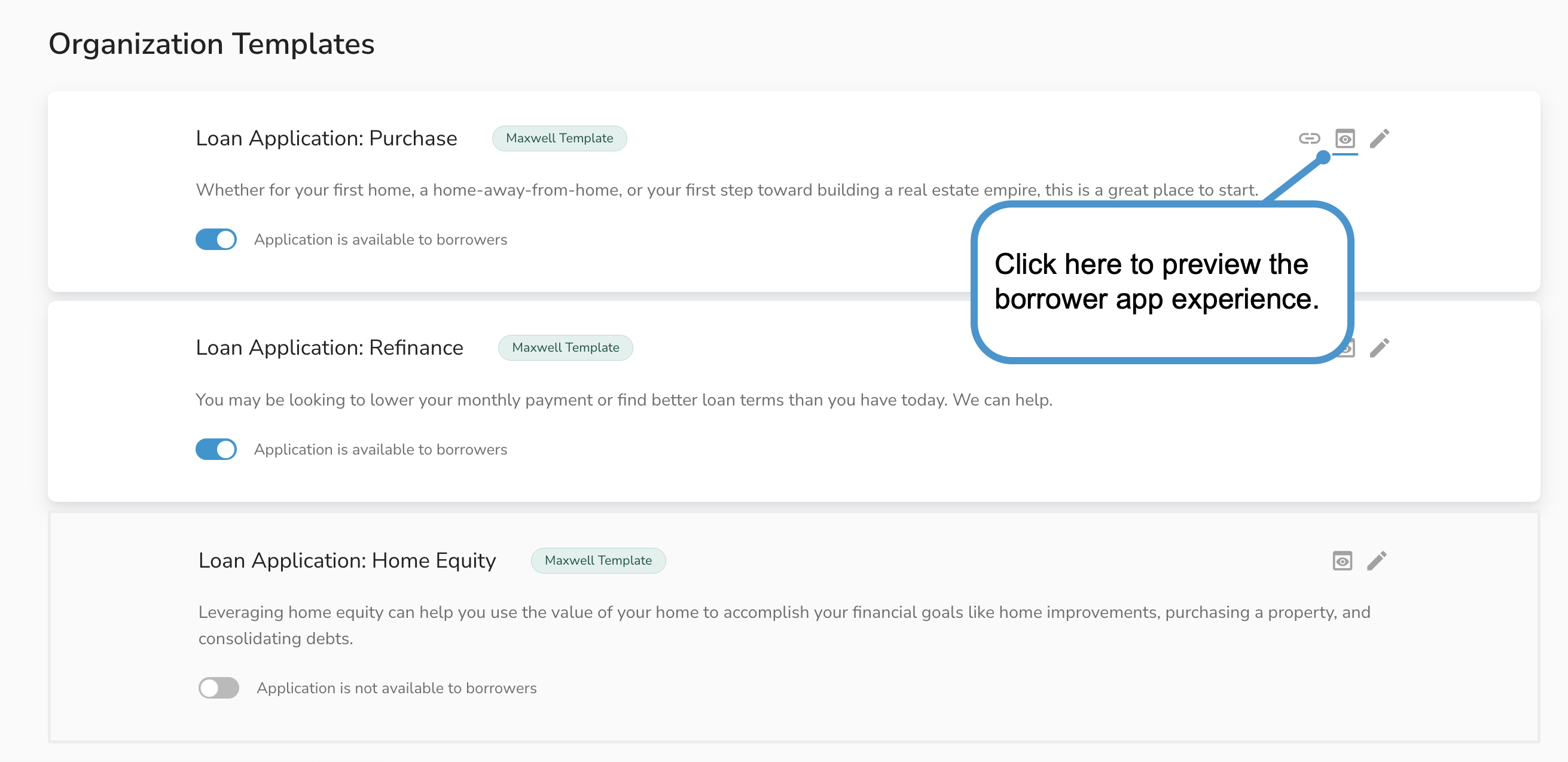

Preview Borrower Experience in Template Manager

For lenders who want to test out their updates to their loan application templates prior to upgrading the application and turning it on for borrowers, they can use the new preview button located in the template manager card to preview the borrower experience.

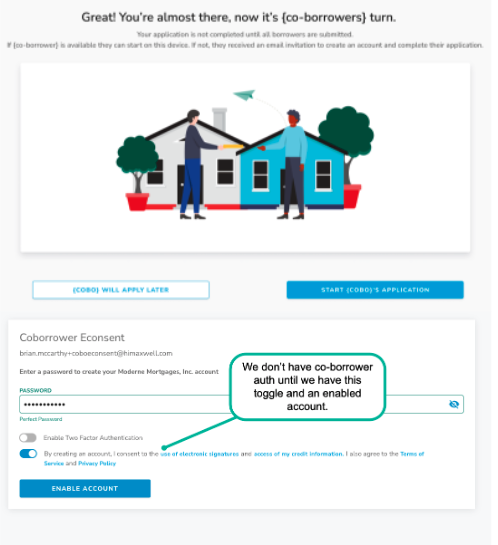

Updated Co-borrowers E-Consent Flow

We updated the co-borrowers E-Consent experience so that even if the co-borrower is completing their application on the same device as their borrower we will log out the borrower and ask the co-borrower to login and explicitly provide their own consent to credit and e-signatures.

Bug Fixes

- Special Characters on Custom Questions - Fixed bug so we can accept answers when the question or answer options contains special characters like & ( $ etc.

- ELA Tasks Displaying in Borrower Task Templates – Fixed a bug so Enhanced Loan Application Tasks display in borrower task templates.

- Brand Logo Displays on Lender Application Page – Fixed a bug so that the brand logo displays on the Lender Application page and not a Maxwell logo.

Week of May 9th

Enhanced Loan Application

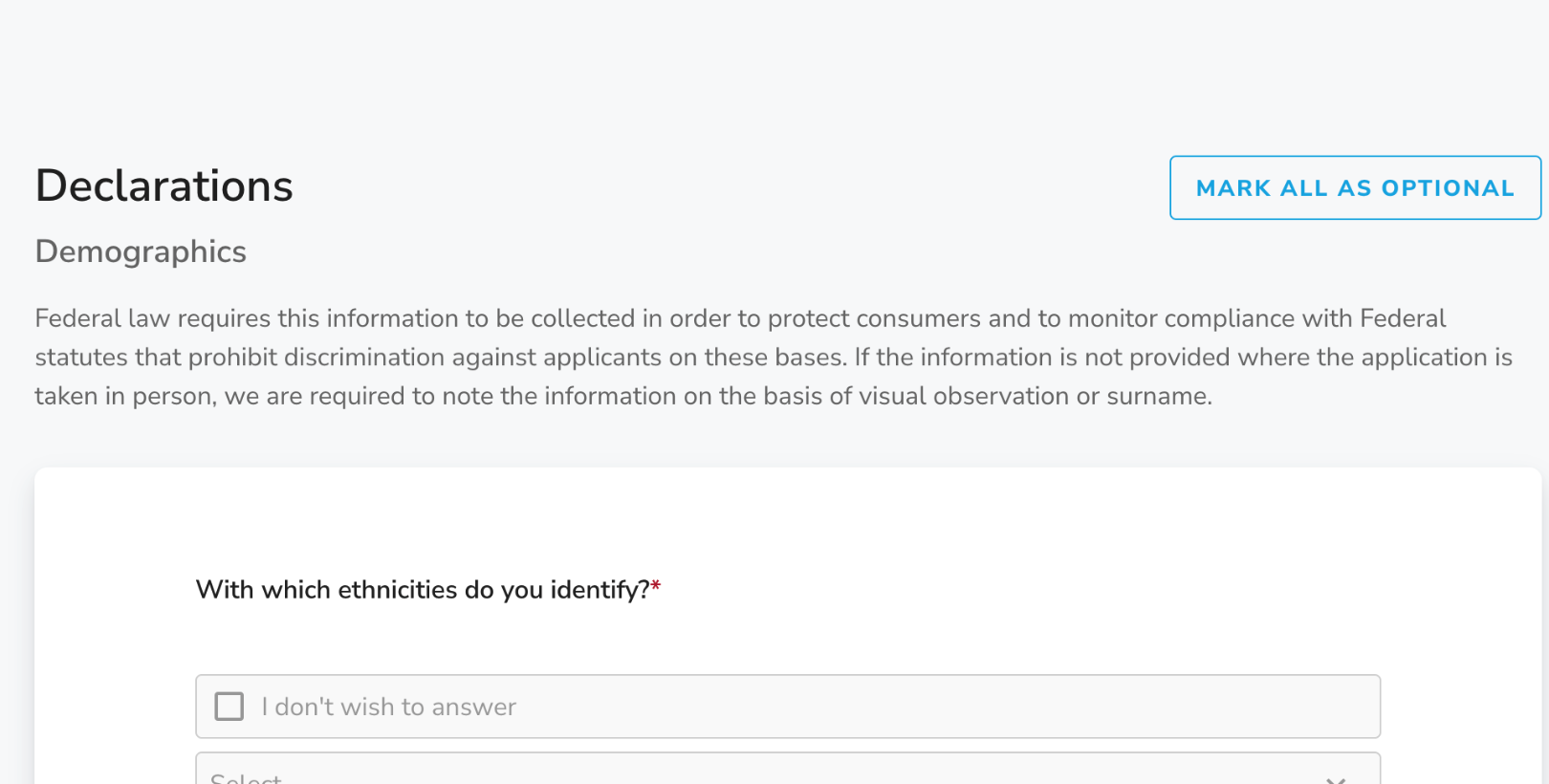

Demographics Disclosure Updates

- Updated Demographics Introduction header for Compliance to "Federal law requires this information to be collected in order to protect consumers and to monitor compliance with Federal statutes that prohibit discrimination against applicants on these bases. If the information is not provided where the application is taken in person, we are required to note the information on the basis of visual observation or surname."

- Added section descriptions to template manager so lenders could see the Demographics introduction text and confirm it meets their requirements

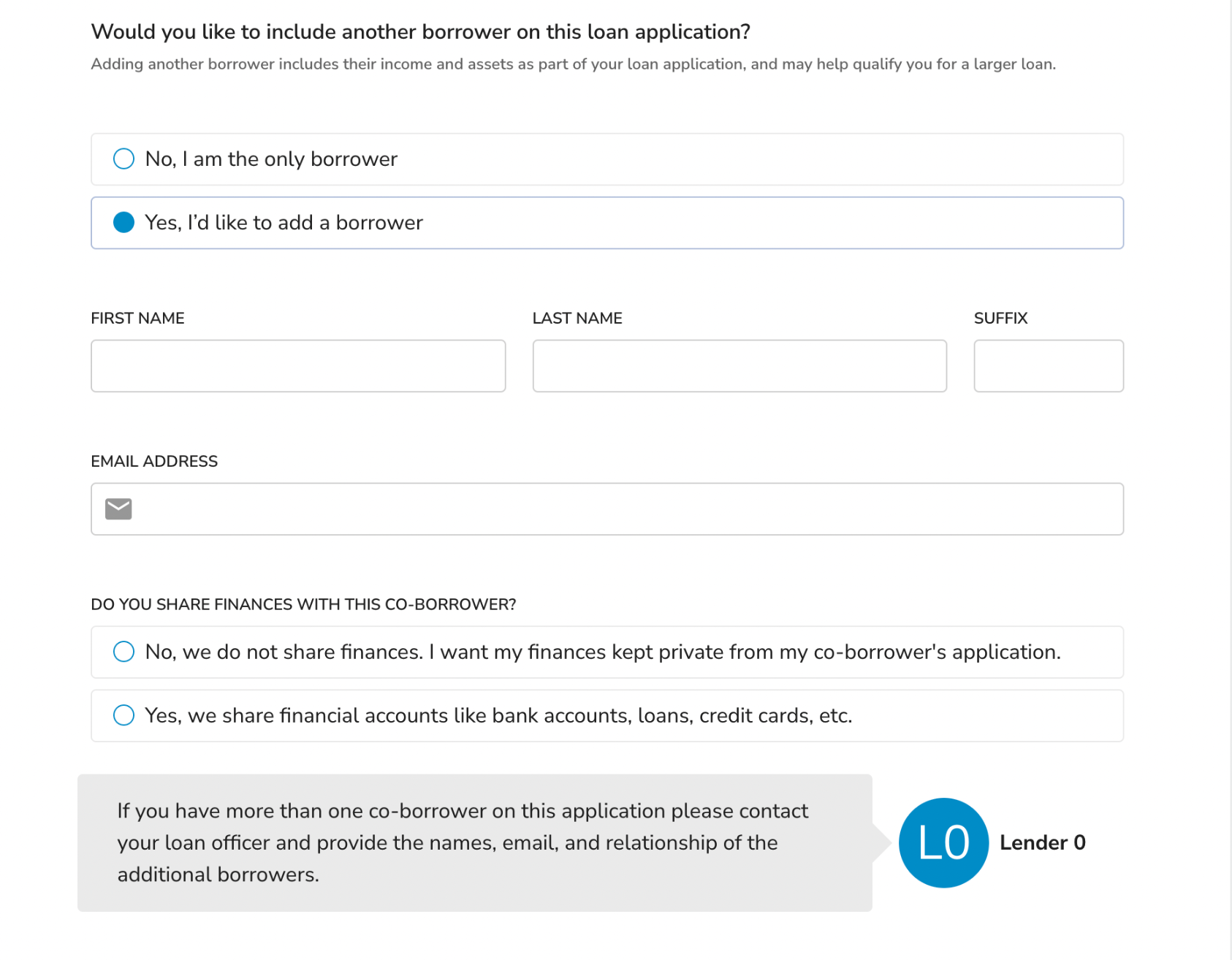

Co-borrower Credit Updates

- Updated all co-borrower applications to Joint Credit Type

- Changed individual vs. joint credit question to Do you share finances with this co-borrower?

Bug Fixes and Code Cleanup

- Fixed validation bugs related to multi-select dropdown fields

- Fixed Mismo mapping issues with fields missing responses

- Fixed permissions so Lenders can edit borrower submitted applications and generate a new 3.4 or re-sync loan applications

- Fixed an issue with google address auto-complete validation blocking borrowers from completing some address fields

Week of May 2nd

Enhanced Loan Application

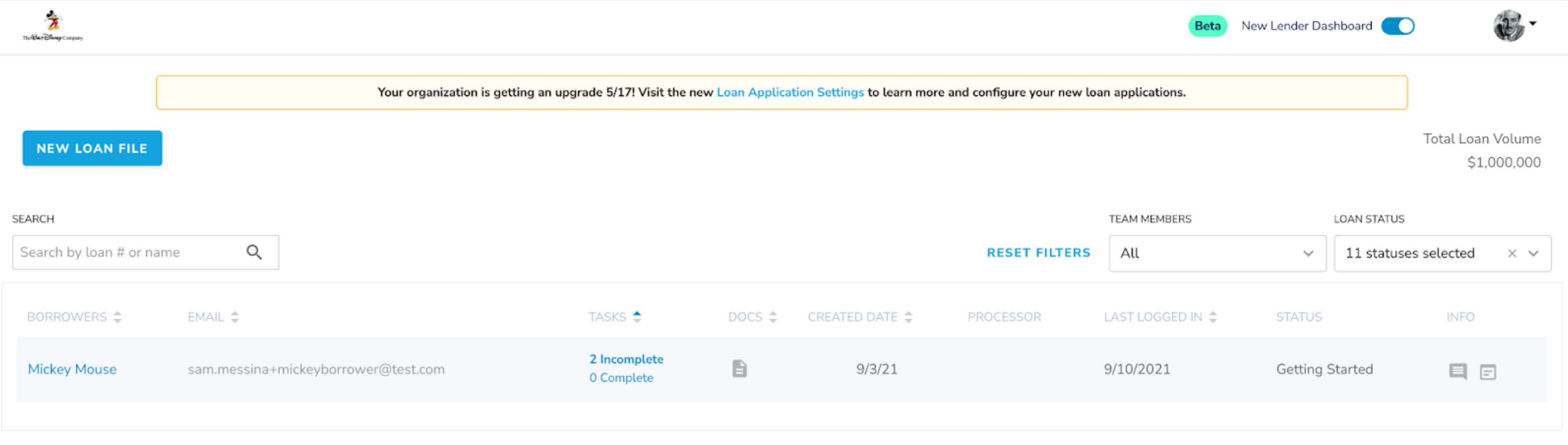

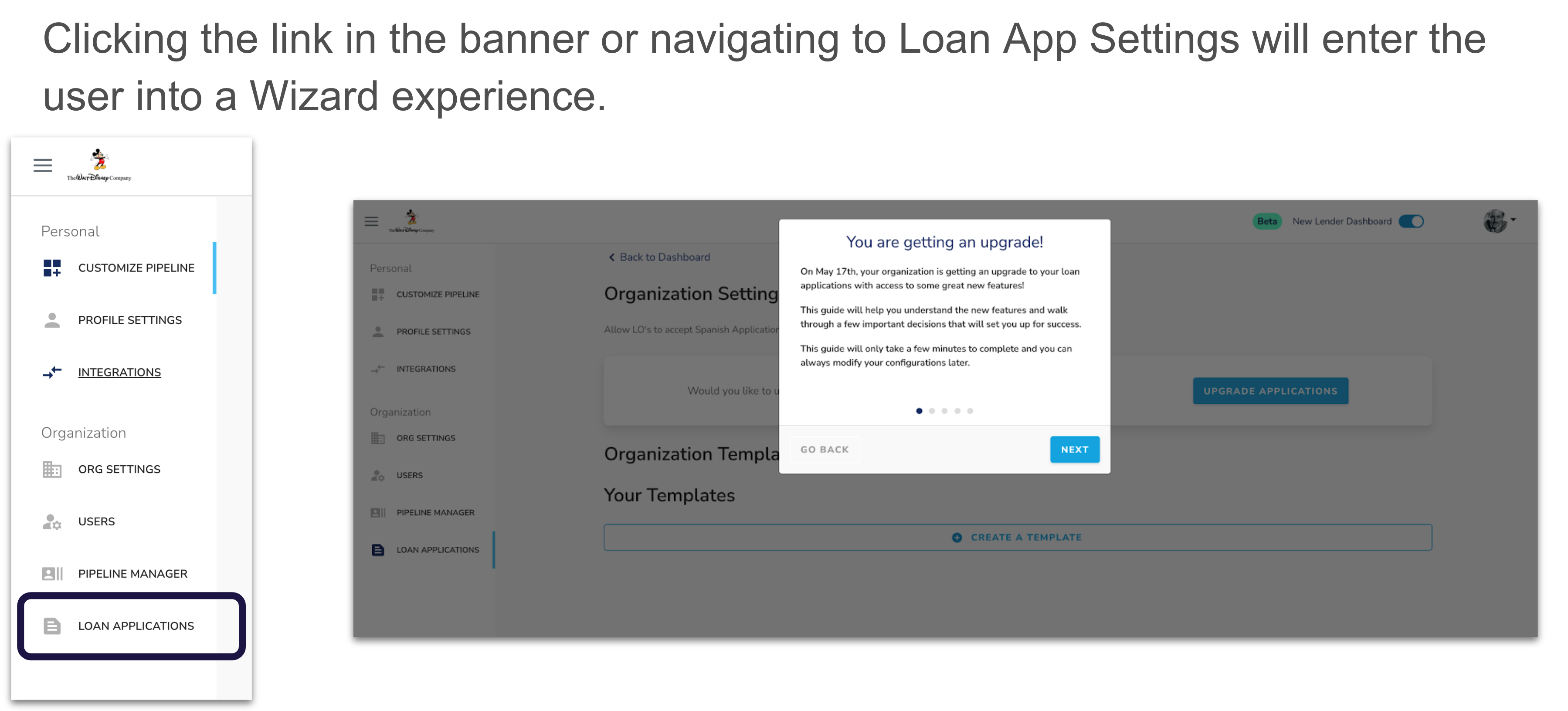

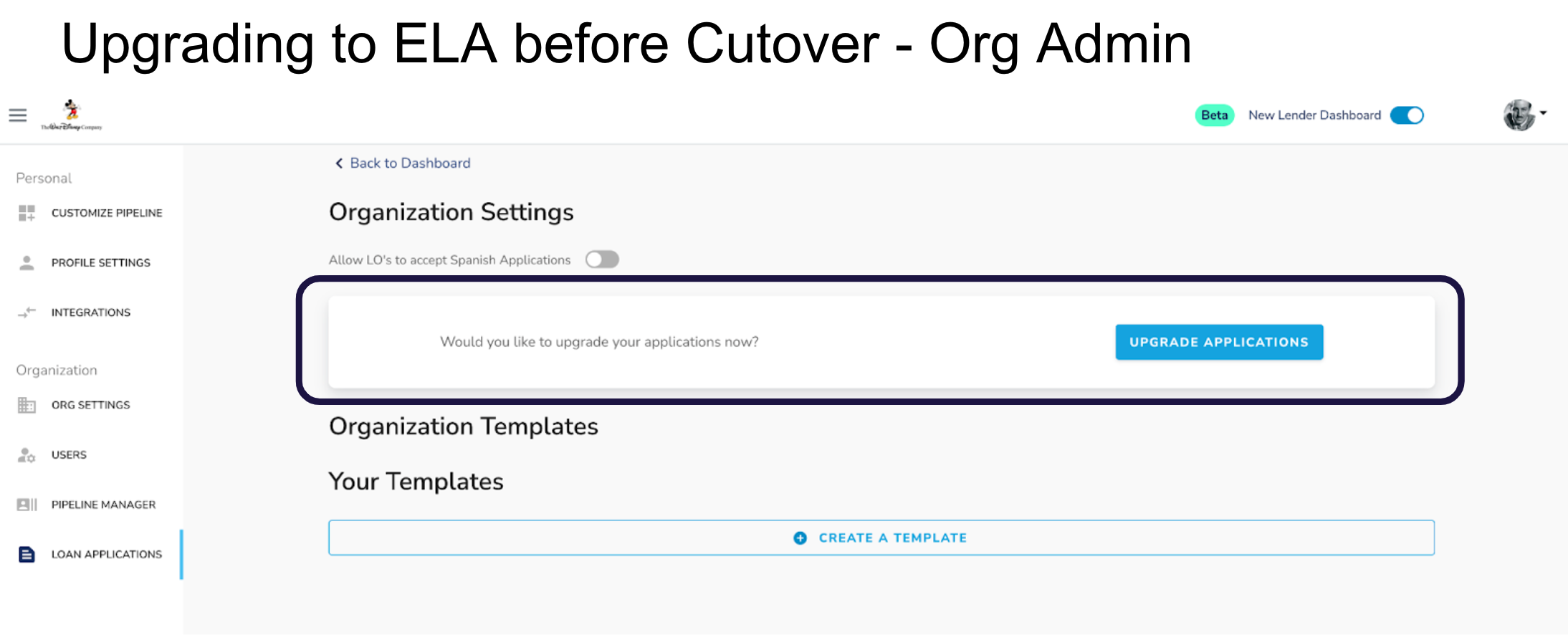

- Sent an invite for Wave 1 organizations to Upgrade their Loan Applications prior

- Walkthrough Wizard to help guide Org Admins through key decisions needed to update the Enhanced Loan Application

- Automatic conversion of Wave 1 customers will take place on May 17th.

Bug Fixes & Code Cleanup

- Map HELOC template to Loan File type for reporting