Week of Feb 27th

Features

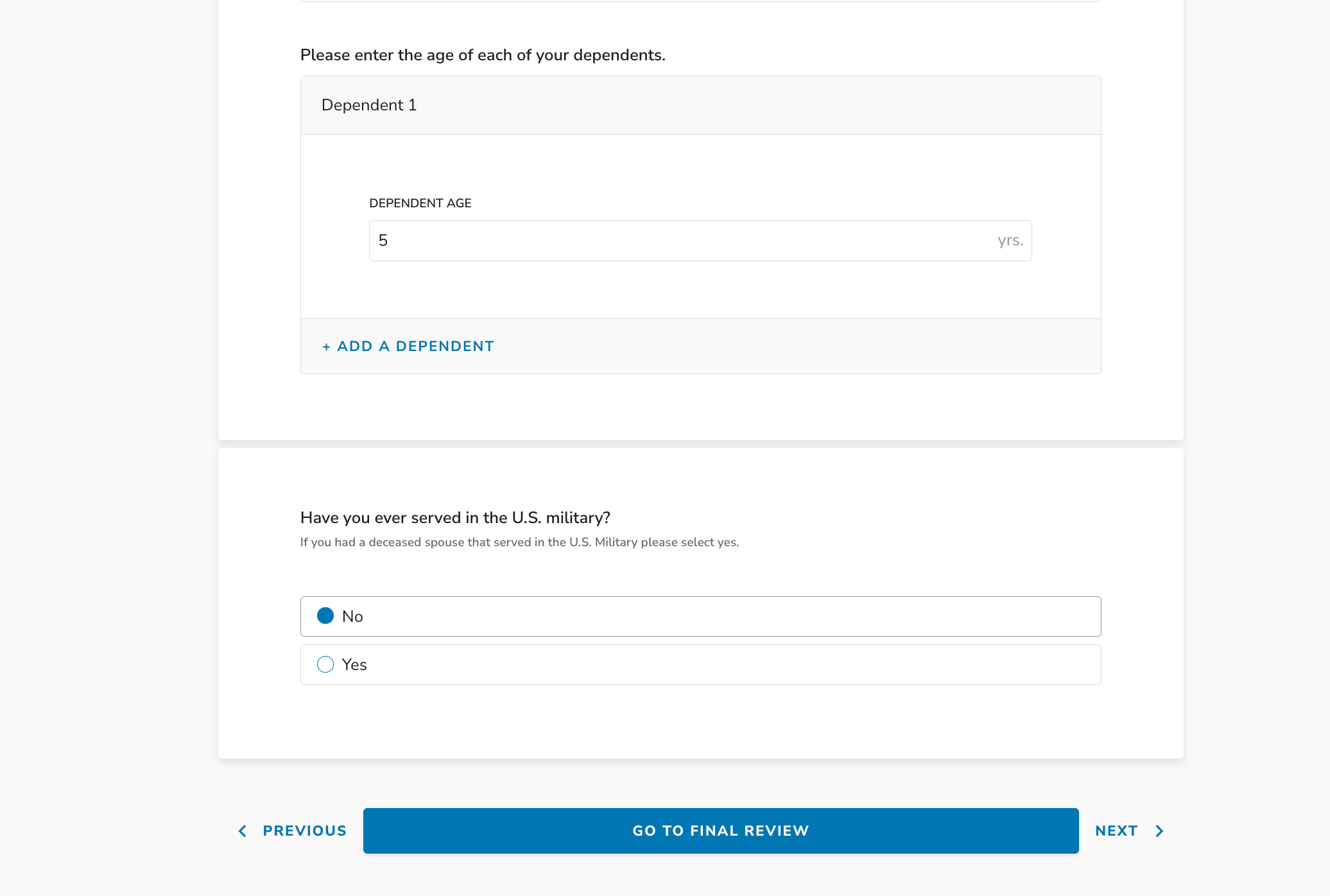

Added Previous, Next, and Go to Final Review navigation buttons in lender loan application

When a lender is navigating a loan application we have added three options for navigation to make it easier for LOs / LOAs reviewing/filling out applications to navigate quickly to where they need to go in the application.

- Previous - Go back to the previous section

- Next - Proceed to next section

- Go to Final Review - Go to final review to see all application data completed so far

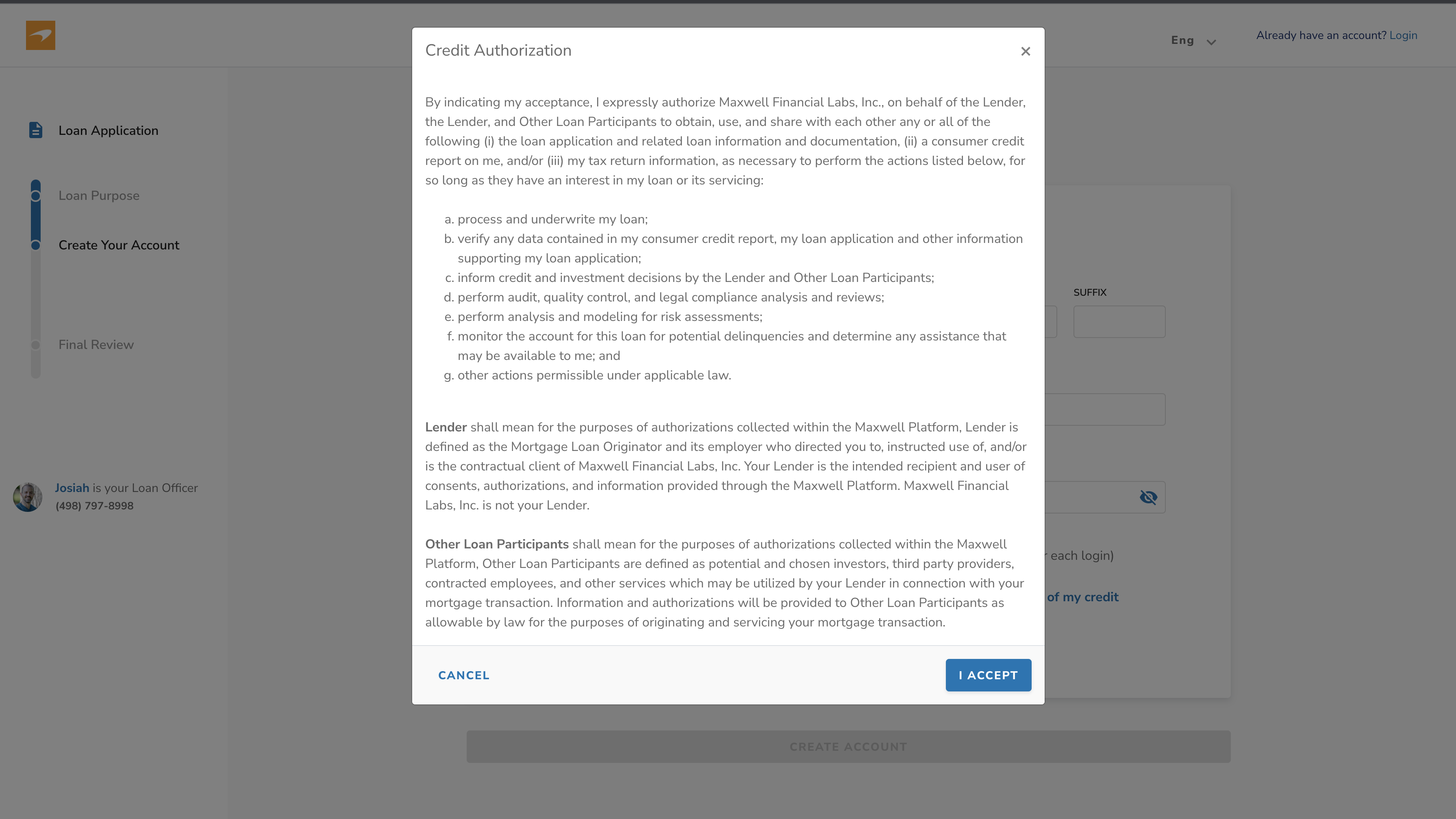

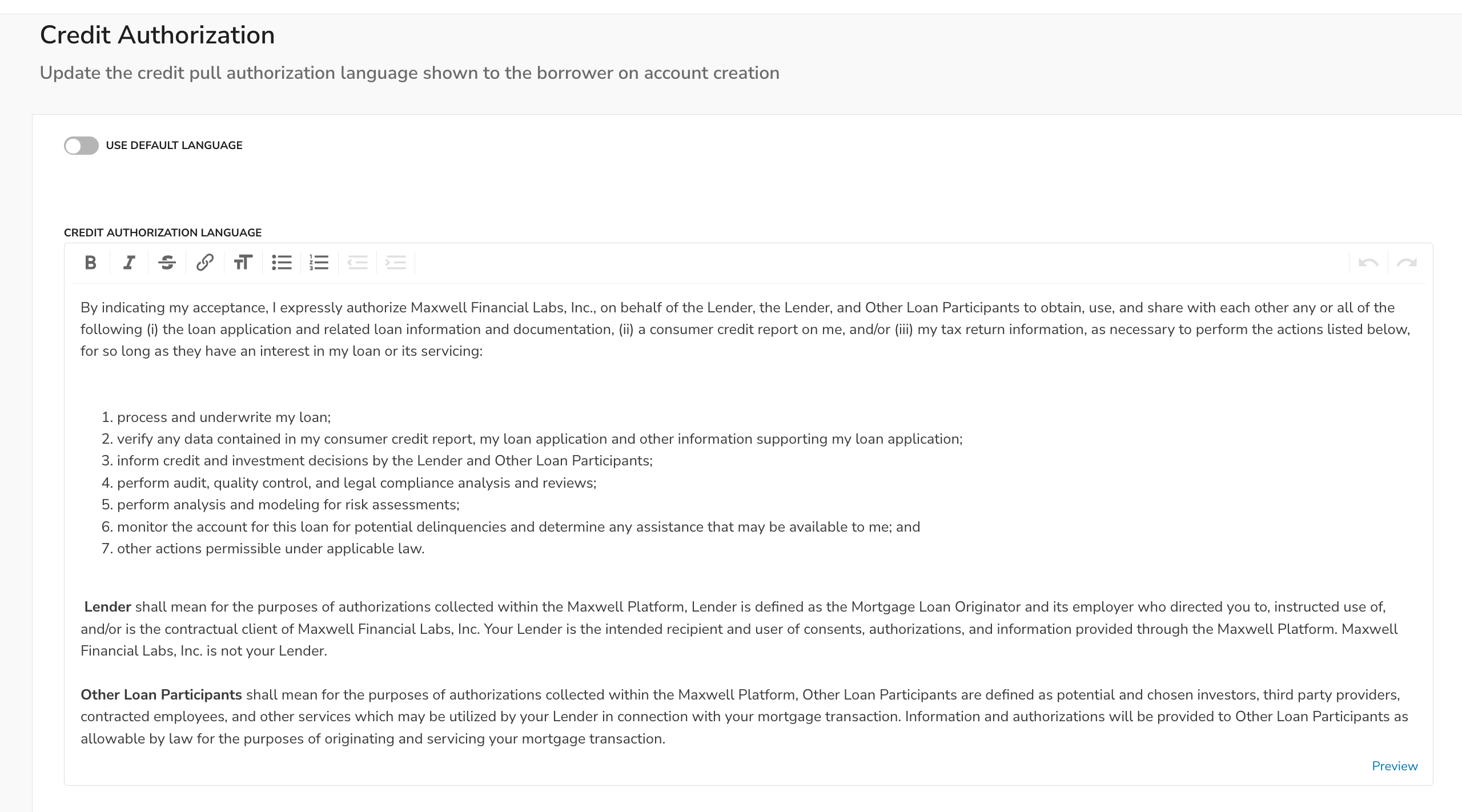

Updated Default Credit Consent Language (#23663)

Under the guidance of our compliance team we updated the default credit authorization language used in our point of sale to bring it in line with the best practice standards and guidelines recommended by the FCRA.

If your organization would like to further configure your credit authorization language follow these steps.

- An org admin logs into Maxwell

- Go to Org settings

- Scroll down to credit authorization and toggle off use default language

- Open the text editor and update your credit authorization

Week of Feb 20th

Features

Added Navigation Bar for Lenders

We updated the lender Loan application experience to allow for lenders to seamlessly move between sections of the application using the menu to the left side of the screen. Note this experience is updated for lenders only, borrowers still need to move through the application section by section to ensure they answer the required questions.

.gif)

Bug Fixes / Code Cleanup

- Hide income fields from Bridge Loan templates #23542

- Updated "Start New Application Button" on repeat borrower experience so that it directs borrowers to an Enhanced Loan Application instead of classic application template. #23479

- Fixed an issue where borrowers with shared finances were not getting directed to the correct submission screen to allow them to begin the co-borrower application. #23545

- Removed impersonation warning from ELA when Lender was continuing as a co-borrower. #23565

- Fixed task buttons styling for text wrapping and size displays on mobile views #23436

- Fixed task due date alignment #23634

- Added Password Reset to info tab for org admins to initiate password reset flow for borrower (#23541)

Week of Feb 13th

Features

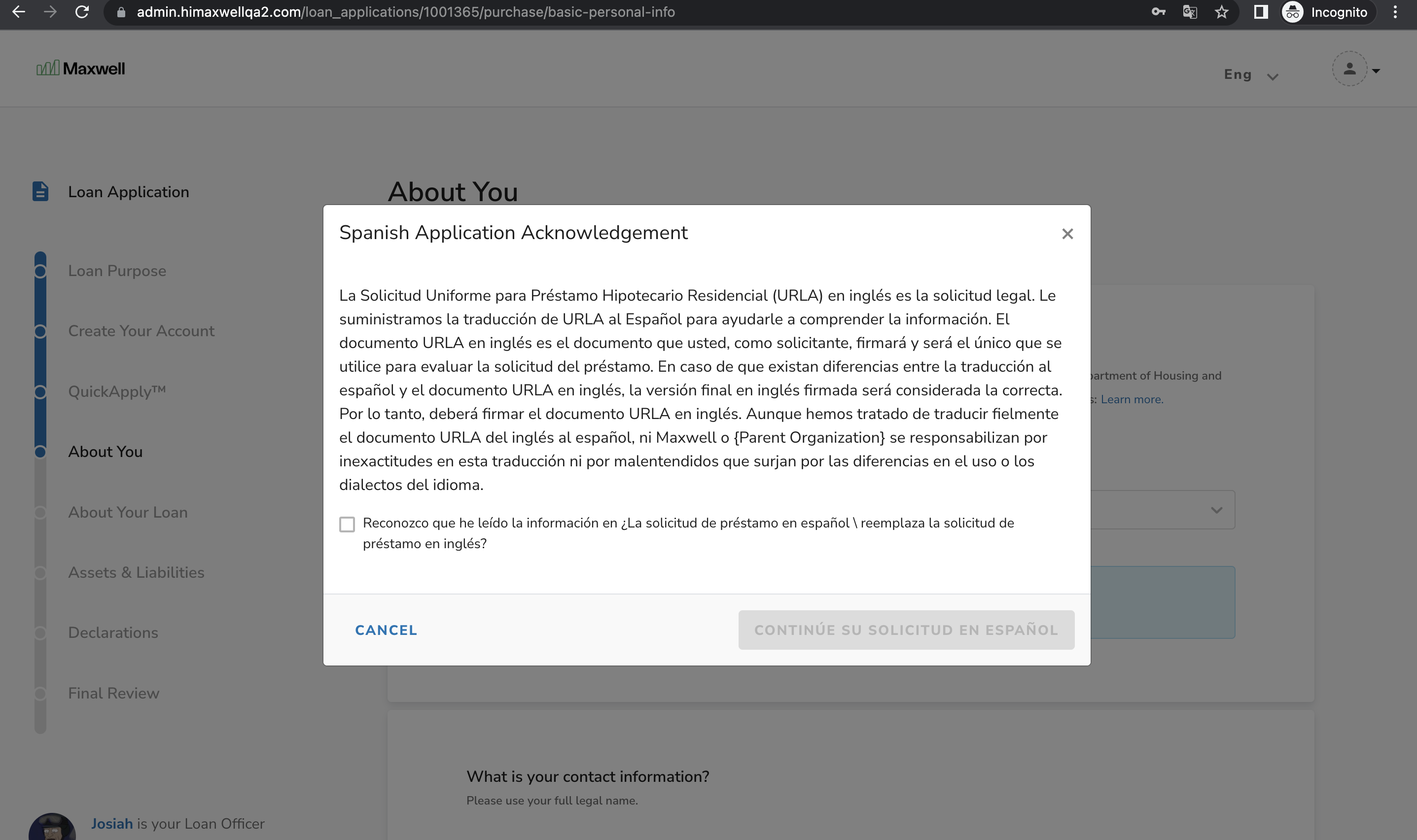

Added Spanish Application Acknowledgment

- Added a modal for Spanish language borrowers to acknowledge that the official loan application document is in English and will be signed in English and that all translations seen are best efforts. (#23366)

Bugs / Code Cleanup

- Added an consent modal for repeat borrowers starting an additional loan application #23368

- Removed LoanPurposed type in Mismo for HELOC template for better template data mapping to LOS #23372

- Fix Language Question not showing validation errors #2345

February 1st - 10th

Features

Added Supplemental Consumer Information Form Questions

The Supplemental Consumer Information Form (SCIF/1103) will be required for new conventional loans sold to Fannie Mae or Freddie Mac with application dates on or after 3/1/2023. This requirement facilitates the collection of homeownership education, housing counseling, and language preference information. To help your team prepare and adapt, we’ve added these questions on all loan applications as of 2/1/2023.

- Added preferred language

- Housing Education

- Housing Counseling question

Bugs / Code Cleanup

- Added Spanish Translations to date pickers in loan application (#23307)

- Display period for bank statement smart task (#23351)

- Remove proof of insurance time period (#23299)

- Added missing data fields to 3.4 import #23318

- Fixed bugs around data trim errors and language preference selections in ELA (#23379)

- Updated the loan application submission language for lender #23360